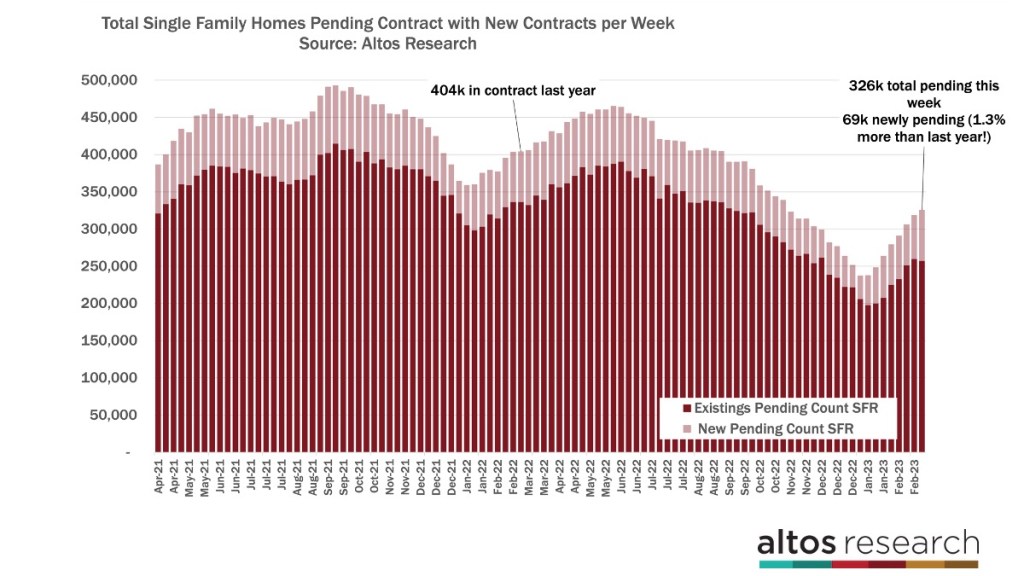

If I told you more homes this week went into contract than last year at this same time, would that surprise you? How can that be? Well these are both supply-constrained markets. So while overall demand is much lower this year, there are still fewer homes on the market than we have demand for. And inventory fell again this week.

This is not a story of too much demand

Two of three home price leading indicators are down year over year. We have some demand, but consumers are very price sensitive. However, we can see the sales pace picking up from last fall’s total shutdown.

Every week, Altos Research tracks every home for sale in the country. We analyze all the pricing, supply and demand, and all the changes in that data and we make it available to you before you see it in the traditional channels.

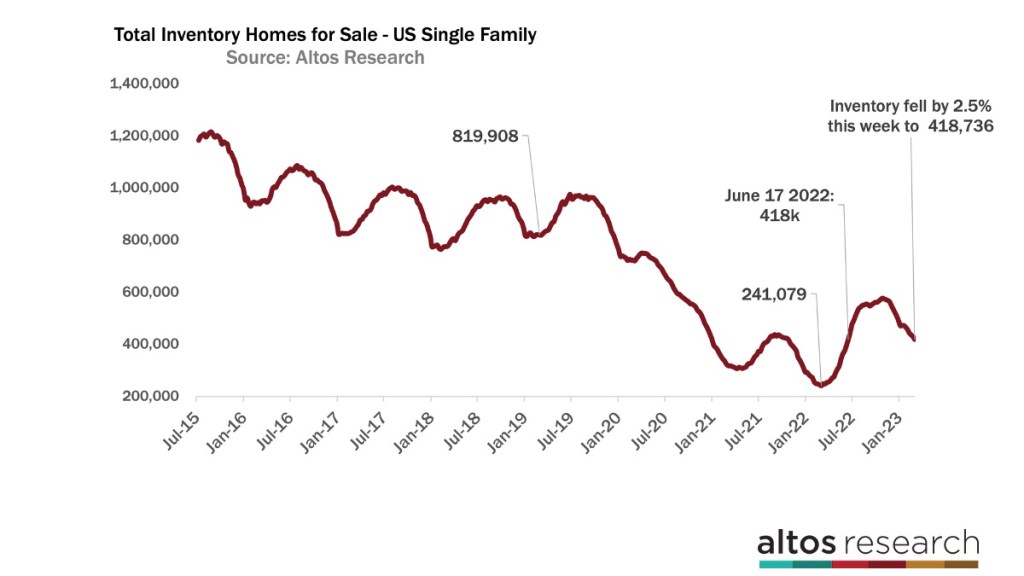

Inventory falls again

Inventory of single family homes available on the market fell by 2.5% this week as yet again we have more buyers than sellers even as we roll into springtime. There are now 418,000 single family homes on the market.

The last time inventory was this low was back in June last year. This week a year ago, the first Friday of March, was the absolute low for inventory with only 241,000 homes on the market. There are now 73% more homes on the market than last year at this time. That difference is about to start shrinking. Remember that we have 49% fewer homes on the market than we did in 2019 before the pandemic.

By March last year interest rates had started climbing to 4% and higher and buyers slowed dramatically. At the same time, would-be sellers were trying to get listed before rates jumped higher, so inventory started building quickly.

By June inventory had crossed above 400,000 and was rising very quickly each week. We’re now on the other side of that slope. Each week, will see a smaller and smaller difference over last year’s inventory.

Inventory in normal years would be climbing each week now, of course, as the best new inventory gets listed for the spring buying season. But with a 2.5% decrease this week the trend hasn’t even slowed — let alone reversed. That says we have a few more weeks of inventory declines. Maybe it drops by 1% or one-half a percent before turning flat and rising in April.

No indication inventory will surge

I’ve said this before but there is no indication of any inventory surging on the market coming from anywhere. There are lots of guesses about where future inventory might come from (recession, job losses, investors panicking) but these things haven’t happened yet. This is important because it’s going to be really hard for the most dire predictions for home price collapse to happen when supply is so restricted.

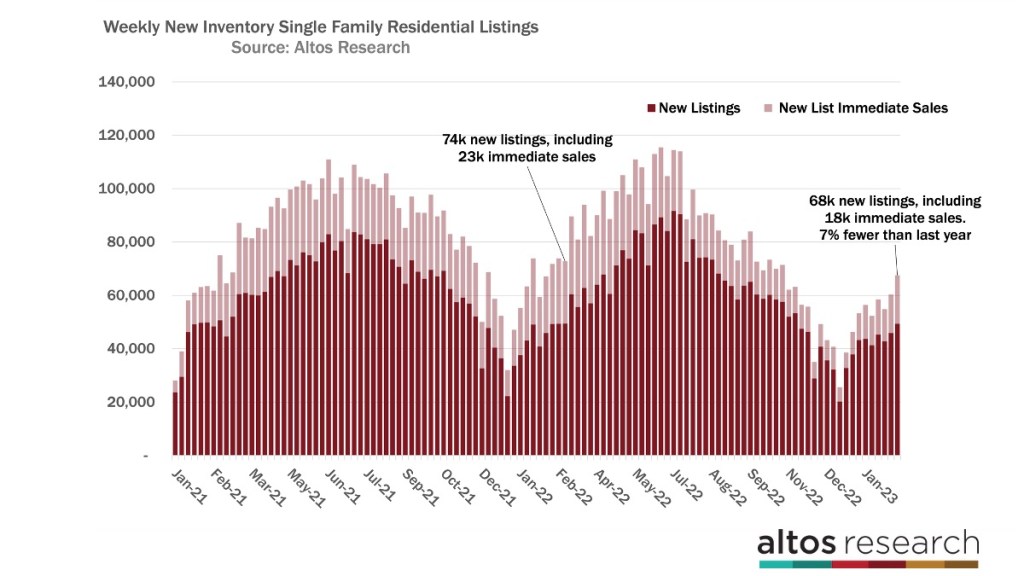

We are starting to see some more listings each week, even though the total new listing rates is still at record lows. There are just very few sellers each week. This week a total of 68,000 new listings with 18,000 of those going into contract — essentially immediately.

Last year, was 74,000 new listings with 24,000 going into contract immediately. It’s wild to me that even in this 7% interest rate environment, we have 18,000 immediate sale.

I was talking to a friend this week whose dream home became available, and he was in an over-asking competitive process with three other potential buyers. The right home, priced right, is always a rare thing. It goes quickly. With 7% fewer new listings than last year, we just won’t have inventory build up until something else changes — a big economic change perhaps.

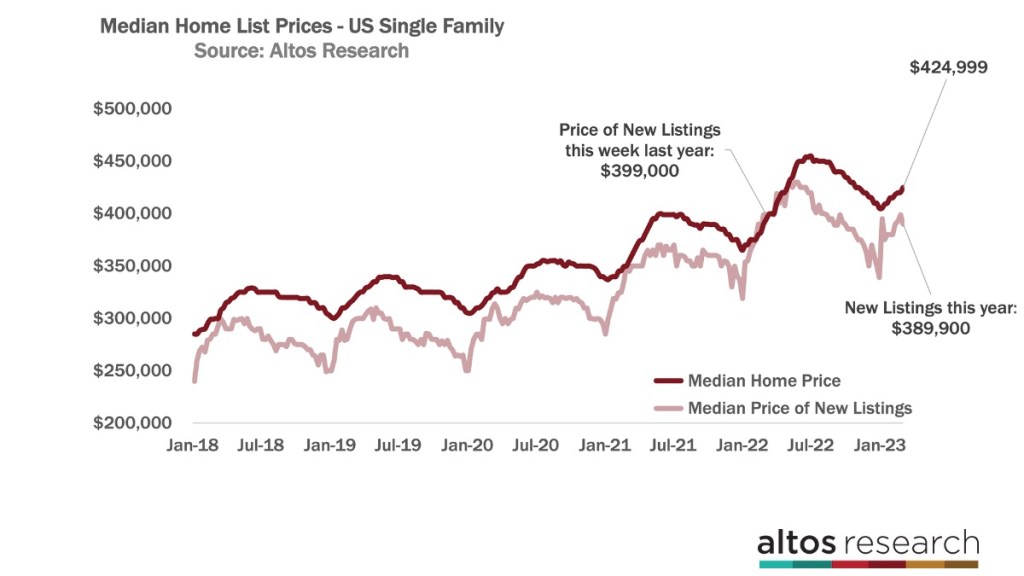

Market slowdown in prices

You can indeed see the market slowdown in prices. Two of three home price leading indicators are lower than last year at this time. That is probably helping demand.

The median price of the new listings this week is $389,900 — last year it was $399,000. That’s the light red line here. Last year sellers were leaning into that momentum and prices were still climbing quickly. That momentum is gone and prices are going sideways.

The median price of single family homes in the U.S. is $424,999 this week — up about 1% from last week. As prices tend to cluster around the round numbers, I’d anticipate we have several weeks at this price point. Each week, the year-over-year price gains get smaller.

This is important to note: Home prices are not falling, but the comparison from last year is getting worse. Last year, prices were rising much more rapidly each week. This tells us that consumers are sensitive to affordability, but that they’re still buying houses.

No evidence of a housing crash

In other words, there is no evidence of any crash in the housing market. Last fall, it looked like there could be, but the facts each week keep dispelling those dire predictions. As I’ve mentioned before, we can see that the headlines will probably show negative year-over-year home price change in the coming months.

Later in the year, if a big recession hits, with lots of job losses, that would be a risk factor that could slow housing dramatically.

It’s surprising, but when we look at the sales rates this week, there were actually more homes going into contract than last year at this time. 69,000 newly pending this week versus 68,000 last year. Both of these markets are supply constrained. Last year, if there were more for sale we’d have had lots more sales. This year, if there were more on the market, maybe we’d have a few more sales.

This is the first week in a long time we’ve had more new contracts than last year. We have 20% fewer homes in contract than we did at that time. 326,000 now vs. 404,000 then. Obviously a dramatically slower market in the second half of last year. But enough happening that sales are ticking up.

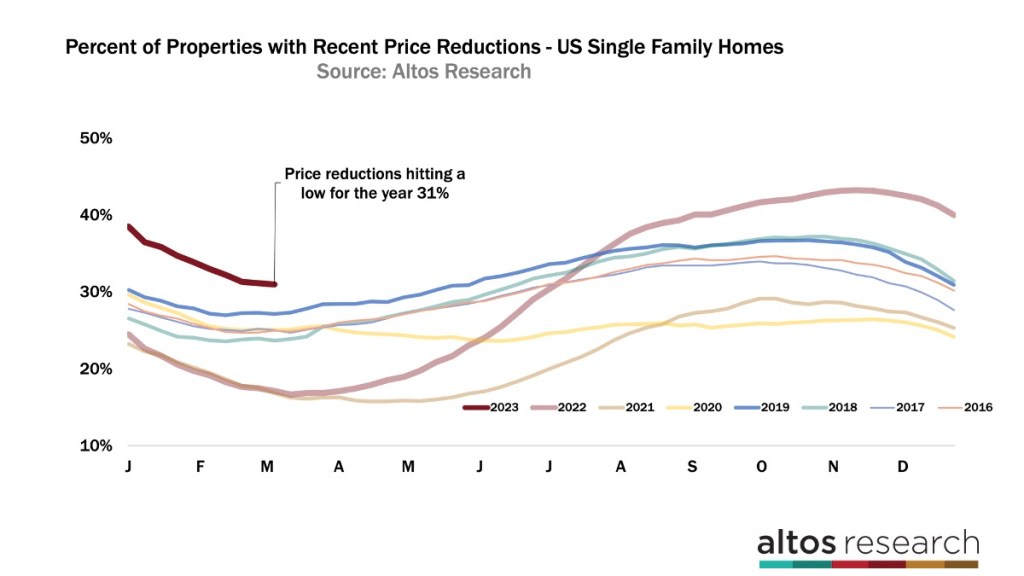

Fewer houses have price reductions

We can indeed see the spring market taking shape with the price reductions data. We’re likely at a low for the year with 31% of the homes on the market having had a recent price cut. That’s just a tiny fraction fewer than last week. As we go into the second quarter, the homes that didn’t sell yet start taking price cuts so this number will climb in the next few weeks.

We focus these videos on the whole U.S., but many local markets are behaving surprisingly differently.

Mike Simonsen is the founder and president of Altos Research.