Average Homeowner Gained $6,400 in Equity, says CoreLogic

CoreLogic’s Home Equity Report for the first quarter indicates that U.S. homeowners with mortgages (about 63% of all properties) have seen their equity increase by 5.6%. Year-over-year, representing a gain of nearly $485.7 billion since the first quarter of 2018.

Year-over-year, representing a gain of nearly $485.7 billion since the first quarter of 2018.

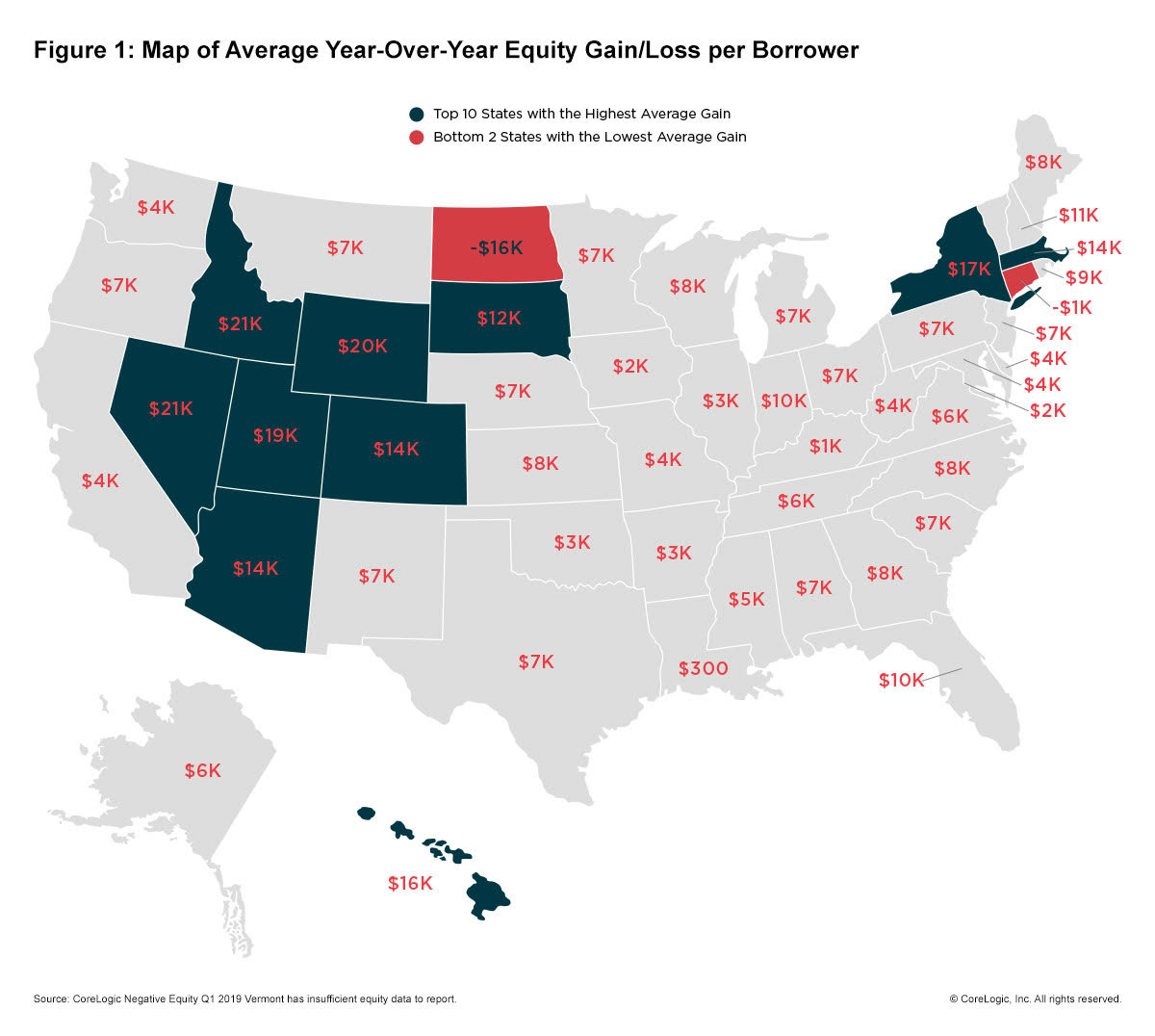

The average homeowner gained $6,400 in home equity between the first quarter of 2018 and the first quarter of 2019. Some states saw much larger gains. In Nevada, homeowners gained an average of approximately $21,000. In Idaho, homeowners gained an average of approximately $20,700 and Wyoming homeowners gained an average of $20,300 (Figure 1).

From the fourth quarter of 2018 to the first quarter of 2019, the total number of mortgaged homes in negative equity decreased 1% to 2.2 million homes or 4.1% of all mortgaged properties. The number of mortgaged properties in negative equity during the first quarter 2019 fell 11%, or by 268,000 homes, from 2.5 million homes, or 4.7% of all mortgaged properties, from the first quarter 2018.

“A moderation in home-price growth has reduced the gains in home-equity wealth and will likely slow the growth in home-improvement spending in the coming year,” said Frank Nothaft, chief economist for CoreLogic. “For larger remodeling projects, homeowners often choose to cash-out some of their home equity through a first-lien refinance or placement of a second lien.”

Negative equity, often referred to as being underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in a home’s value, an increase in mortgage debt or both. Negative equity peaked at 26% of mortgaged residential properties in the fourth quarter of 2009, based on the CoreLogic equity data analysis, which began in the third quarter of 2009.

The national aggregate value of negative equity was approximately $304.4 billion at the end of the first quarter of 2019. This is up approximately $2.5 billion from $301.9 billion in the fourth quarter of 2018 and up year over year by approximately $18 billion from $286.4 billion in the first quarter of 2018.

“The country continues to experience record economic expansion as illustrated by these increases in home equity,” said Frank Martell, president and CEO of CoreLogic. “We expect home equity to continue increasing nationally in 2019, albeit at a slower pace than in recent years.”