The Product: Alt.Estate Platform

The Alt. Estate platform is the first attempt at tokenizing the real estate industry. Alt. Estate is a real estate cryptocurrency and trading platform that aims at decentralizing the real estate process and building a true peer-to-peer system. With Alt. Estate, investors can buy fractions of a property at a low cost and still see returns. Alt. Estate’s goal is to open up real estate investing to everybody. Their goal is to become the industry standard for blockchain-based real estate transactions.

Challenges/Opportunity

Alt. Estate has a few unique selling points. First, it works to decentralize the real estate process, which could be bad news for real estate professionals simply because it can allow two parties to make a deal without them. However, there can be a benefit to a consumer who wants to cut costs – Alt. Estate’s trading fee is also about 2%. The platform also can cut down on transaction times by eliminating third-party brokers, lawyers, and banks by assuming their functions such as listings, document flow, and payments — all of which is done within the system. Standard registration of the title of deeds with notarized documents typically takes up to 60 days, with Alt. Estate this takes less than 10 minutes.

The system makes it easy for international investors, as well. Liquidity is reached because real estate owners get access to both fiat and cryptocurrency investors without traditional cross-country boundaries, which speeds up the property sales process. Also, fractional ownership enables purchasing real estate with less money, making it easier for more people to build a portfolio. Alt. Estate provides a new level of transparency for investors, every action taken on a property is recorded on the blockchain.

Breaking it down:

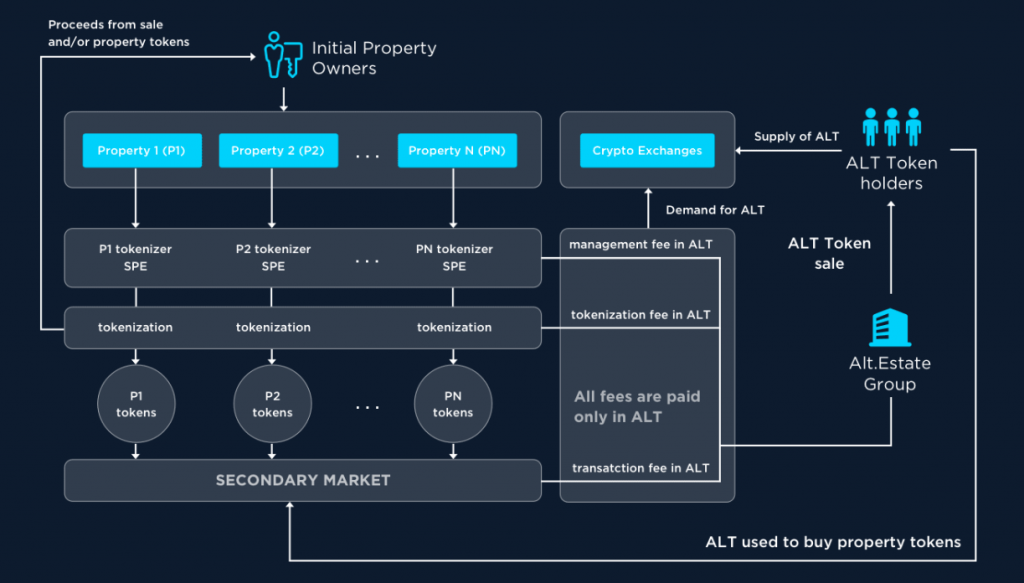

- An owner wants to sell their property or any fraction of it.

- A property is checked and appraised, and Alt.Estate takes a small management fee.

- Estate tokenizes the property virtually, dividing it into multiple fractions. Alt. Estate takes another small fee. Each property is issued tokens unique to that property.

- The property tokens are then sold to investors (who pay using Alt Tokens) who can then choose to buy as many fractions of a property as they want.

- The initial property owners then get the Alt Tokens used in the sale of property tokens, in which they can then cash them.

- Then, the property-specific tokens are traded on the Alt. Estate platform. Investors may sell their property tokens anytime on the platform for Alt Tokens, which then can be traded out for cash.

What Does This Mean to You?

Currently Alt. Estate is experiencing substantial growth. Their plans for expansion involve helping construction companies increase sales by providing tokenized real estate as a solution. They’re building ready-to-use widgets for their websites, so they can use this system without developing their own blockchain infrastructure.

Perhaps in the future, we will see real estate brokerages partnering with Alt. Estate in a similar way. Real estate companies today should think about how they can provide solutions to speed up the transaction process as well as lower consumer-facing costs. In today’s age of instant information, I can see the next generation of homebuyers sacrificing some of the typical services of a real estate brokerage for quicker, cheaper and more transparent service.

Is the tokenization of real estate a fad or the future? Let us know what you think!