Highest Potential SFR Returns in Baltimore, Macon, Montgomery, Detroit, Atlanta;

Report Also Identifies Best SFR Growth Markets and Best Low Risk-High Return SFR Markets

ATTOM Data Solutions, curator of the nation’s premier property database, today released its Q1 2018 Single Family Rental Market report, which ranks the best U.S. markets for buying single family rental properties in 2018.

The report analyzed single family rental returns in 449 U.S. counties each with a population of at least 100,000 and sufficient rental and home price data. Rental data was from the U.S. Department of Housing and Urban Development, and home price data was from publicly recorded sales deed data collected and licensed by ATTOM Data Solutions (see full methodology below).

The average annual gross rental yield (annualized gross rent income divided by median purchase price of single family homes) among the 449 counties was 8.9 percent for 2018, down from an average of 9.2 percent in 2017.

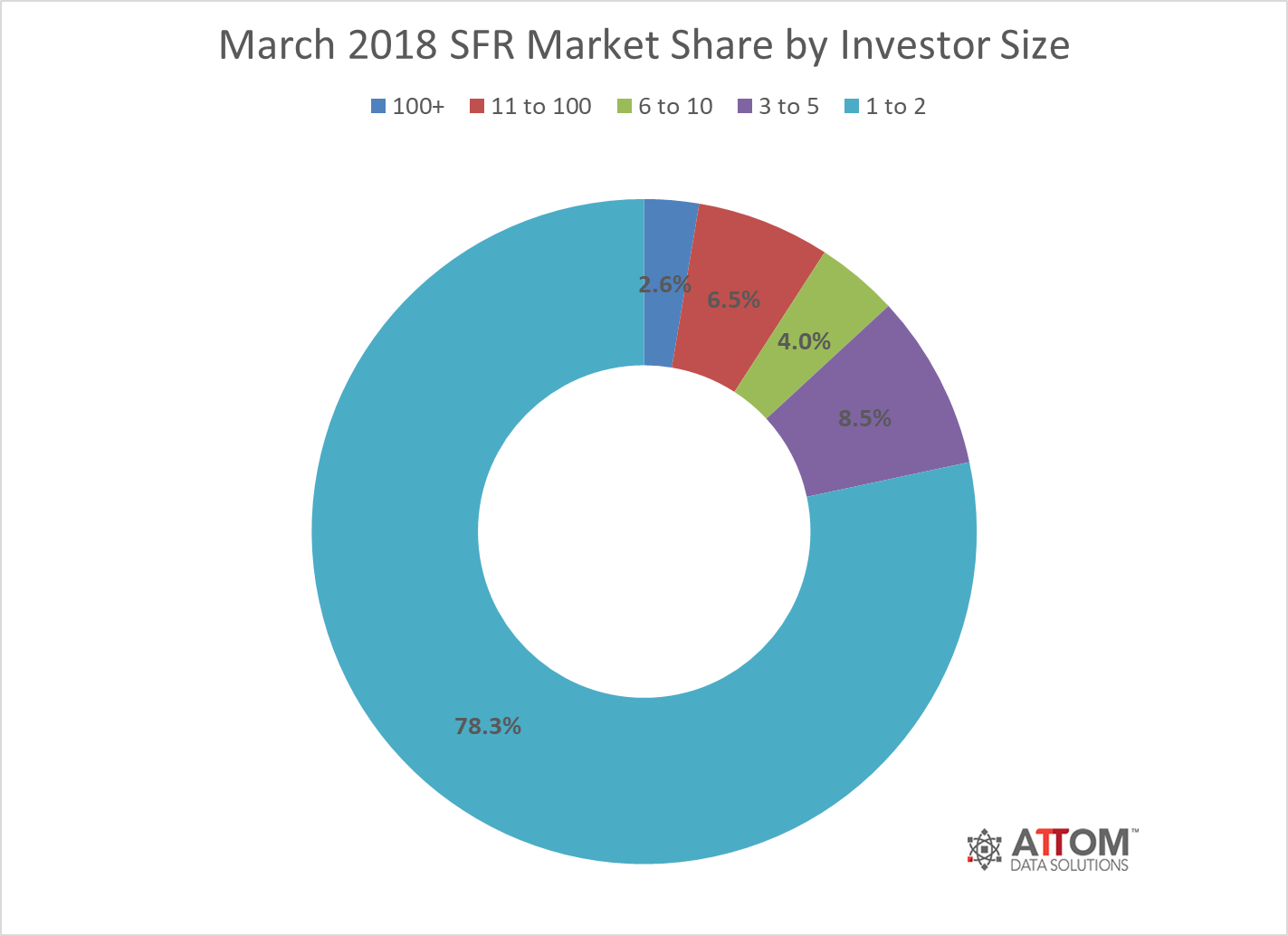

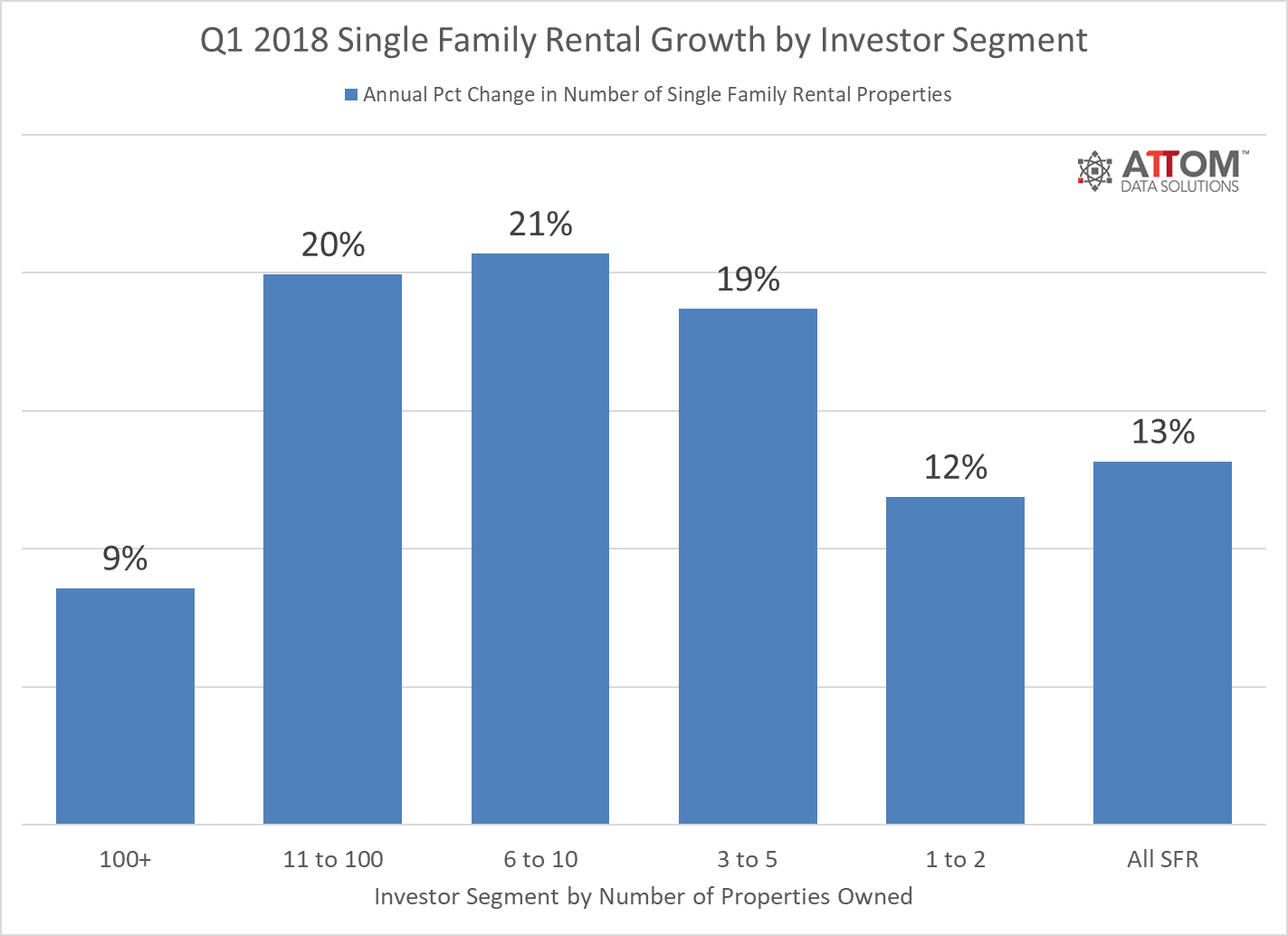

“Despite declining returns in many areas, the single-family rental market continues to grow thanks to more activity by smaller and middle-tier investors,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “The biggest increase in market share over the past year has come among investors owning six to 10 single family rentals, followed by those owning between 11 and 100 rentals. These smaller to mid-tier investors are benefitting from newfound efficiencies in acquisition, financing and property management that allow them to buy outside their backyard in areas with higher potential returns, and to leverage their money to buy more properties.”

Counties in Baltimore, Macon, Montgomery, Detroit, Atlanta post highest rental returns

Counties with the highest potential annual gross rental yields for 2018 were Baltimore City, Maryland (28.6 percent); Bibb County, Georgia in the Macon metro area (21.8 percent); Montgomery County, Alabama, in the Montgomery metro area (21.7 percent); Wayne County, Michigan in the Detroit metro area (21.7 percent); and Clayton County, Georgia in the Atlanta metro area (20.3 percent).

“With continued job growth in Cleveland and Atlanta, Divvy is seeing a significant year-over-year increase in the percent of highly-qualified single-family renters, who are often less than two years away from mortgage qualification,” said Tiffany Li, co-founder of Divvy Homes, a tech startup that provides lease options with an equity-building component. “This population is seeking SFRs in neighborhoods that are largely owner-occupied and with family-friendly amenities and good schools. We’ve continued to see strong and growing demand through the Midwest and Southeast for lease options and other unconventional rental options that allow highly-qualified renters to move towards homeownership.”

Along with Wayne County, Michigan, the highest potential annual gross rental yields among counties with a population of at least 1 million were Cuyahoga County (Cleveland), Ohio (11.6 percent); Philadelphia County, Pennsylvania (10.0 percent); Cook County (Chicago), Illinois (9.5 percent); and Harris County (Houston), Texas (9.5 percent).

“At Roofstock we are seeing increasing interest from investors in a number of SFR markets that have historically not gotten much love from the large institutional players,” said Gary Beasley, CEO and co-founder at Roofstock, an online marketplace for single family rentals. “These include many cities in the Midwest, South, Southeast and even certain markets in the Northeast. Investors are attracted to the strong rental yields in many of these less flashy cities like Cleveland, Pittsburgh and Detroit, as well as perennial favorites like Atlanta, Houston and Charlotte which have been popular with investors for several years. The nice thing about SFR is there is enough variety out there that there really is something for every investor, depending on their unique objectives.”

Rental returns increase from year ago one-third of counties

Potential annual gross rental yields for 2018 increased compared to 2017 in 150 of the 449 counties analyzed in the report (33 percent) led by Rowan County, North Carolina in the Charlotte metro area (up 36 percent); Randolph County, North Carolina in the Greensboro metro area (up 32 percent); Tazewell County, Illinois, in the Peoria metro area (up 21 percent); Baltimore City, Maryland (up 21 percent); and Kings County, California in the Hanford-Corcoran metro area (up 20 percent).

“As the stock market starts to show some weaknesses, investors continue to put their money into cash flowing assets such as rental properties,” said Ross Hamilton, CEO at Connected Investors, an online community for real estate investors. “Many view rental real estate as a way to recession-proof their income and retirement.”

Among counties with a population of at least 1 million, those with the biggest increase in potential annual gross rental yields for 2018 compared to 2017 were Harris County (Houston), Texas (up 7 percent); King County (Seattle), Washington (up 7 percent); Queens County, New York (up 5 percent); Contra Costa County, California (up 4 percent); and Cook County (Chicago), Illinois (up 3 percent).

“The single-family rental market in Seattle remains strong, which is a good thing for the people who own the rentals, but not so good for tenants as rents continue to escalate,” said Matthew Gardner, chief economist with Windermere Real Estate, covering the Seattle market. “Demand for rentals is high but some of this is due to Seattle’s rising home prices. Growth in rental rates is robust in the core Seattle market, but as you move further away from the city it starts to soften due to more modest income growth in those areas.”

Counties in DC, Bay Area, Nashville, Brooklyn post lowest rental returns

Counties with the lowest potential annual gross rental yields for 2018 were Arlington, Virginia, in the Washington, D.C. metro area (3.6 percent); Santa Clara County, California, in the San Jose metro area (3.6 percent); San Mateo County, California, in the San Francisco metro area (3.7 percent); Williamson County, Tennessee, in the Nashville metro area (4.0 percent); and Kings County (Brooklyn), New York (4.0 percent).

Along with Santa Clara County, California and Kings County, New York, the lowest potential annual gross rental yields among counties with a population of at least 1 million were in Orange County (Los Angeles metro area), California (4.5 percent); Fairfax County, (Washington, D.C. metro area) Virginia (4.6 percent); and Los Angeles County, California (4.9 percent).

Rents rising faster than wages in 84 percent of markets

Rents rose faster than wages in 375 of the 449 counties analyzed (84 percent), including Los Angeles County, California; Cook County (Chicago), Illinois; Harris County (Houston), Texas; Maricopa County (Phoenix), Arizona; and San Diego County, California.

Wages rose faster than rents in 74 of the 449 counties analyzed (16 percent), including Nassau County (Long Island), New York; Pima County (Tucson), Arizona; Westchester County, New York; Erie County (Buffalo), New York; and Duval County (Jacksonville), Florida.

Best SFR growth markets in Cleveland, Columbia, Pittsburgh, Rockford, Atlanta

The report identified 24 “SFR Growth” counties where average wages grew over the past year and with potential 2018 annual gross rental yields of 10 percent or higher.

The 24 SFR Growth markets included Cuyahoga County (Cleveland), Ohio; Richland County (Columbia), South Carolina; Westmoreland County (Pittsburgh), Pennsylvania; Winnebago County (Rockford), Illinois); and Clayton County, Georgia in the Atlanta metro area.

“Relatively low home prices combined with rising rents in most areas make Ohio still very attractive for single family rental investors,” said Matthew L. Watercutter, broker of record for HER Realtors, covering the Dayton, Columbus and Cincinnati markets in Ohio. “Demand for these single family rentals is helping to push up home prices faster than rents in the majority of Ohio markets, indicating that the opportunity may not be as stellar in future years.”

Best low-risk, high return SFR markets in Greensboro, Joplin, Atlanta, Charlotte

The report identifies 30 “Low Risk-High Return” counties where the 2018 potential annual gross rental yields were 10 percent or higher and where the investment property vacancy rate was 5 percent or lower and where the property tax rate was 1 percent or lower.

These counties were led by Randolph County (Greensboro), North Carolina; Jasper County (Joplin), Missouri; Newton County (Atlanta), Georgia; Rowan County (Charlotte), North Carolina; and Wicomico County (Salisbury), Maryland.

Methodology

For this report, ATTOM Data Solutions looked at all U.S. counties with a population of 100,000 or more and with sufficient home price and rental rate data. Rental returns were calculated using annual gross rental yields: the 2016 50th percentile rent estimates for three-bedroom homes in each county from the U.S. Department of Housing and Urban Development (HUD), annualized, and divided by the median sales price of residential properties in each county.

About ATTOM Data Solutions

ATTOM Data Solutions blends property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties multi-sourced from more than 3,000 U.S. counties. A rigorous data management process involving more than 20 steps validates, standardizes and enhances the data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. With more than 29.6 billion rows of transactional-level data and more than 7,200 discrete data attributes, the 9TB ATTOM data warehouse powers real estate transparency for innovators, entrepreneurs, disrupters, developers, marketers, policymakers, and analysts through flexible delivery solutions, including bulk file licenses, APIs and customized reports.