Humans Are The Value Wedge!

Your brokerage’s unique personality and knowledge are what give you the edge.

Have you observed that money flows to value? Our value proposition typically answers three basic questions:

- How do I solve a client’s problem? (pain)

- How do I make them feel good? (pleasure)

- How am I different from competitors? (value wedge)

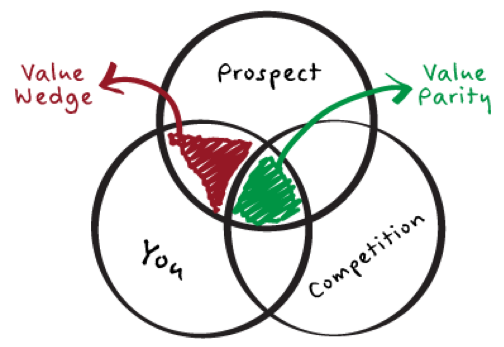

The third question involves our value wedge, as shown in the diagram below.

Value Parity is what nearly all sales associates and companies provide, including competitors. Examples for a seller include a yard sign, multiple listing service (MLS), and home brochure. Nearly everyone offers these services, so they are not differentiating. The seller wants to know what we do that is different and valuable. This is the Value Wedge.

What is the most significant component of the value wedge? In my observation, it is the human factor–the unique personality, caring, knowledge, rapport, and skills of the person delivering the service. Take the human element out, and you come close to having a commodity. Commodities have a reduced value.

Are We Improving Service?

In our efforts to improve technology, are we enhancing our service or commoditizing it? Here’s an example from the mortgage industry. After five days with 116 top-producing mortgage loan officers, they all agreed on one thing: Their companies’ efforts to improve technology had commoditized certain parts of their business, making it harder for them to build relationships, counsel borrowers, and create a value wedge.

Buyers jump on the various prequalification apps to find the best rate. What buyers need is to find the best loan for their situation. This comes with counseling. For example, if the buyers have limited cash, the best loan for them may be one that takes less cash but has a slightly higher rate. The opportunity for the loan officer to counsel the borrower to find the best loan may never happen.

In many cases, the value wedge and the human factor are being eliminated in the prequalification process. By the time the loan officer sees the computerized prequal and follows up on it, the buyers are confused. Has this process improved the borrower’s experience? According to the loan officers, it has increased confusion and lowered conversion rates from prequal to application.

What about the real estate brokerage industry? Will the current tech race and infatuation with ibuyers commoditize the brokerage transaction? Is technology making it better consumers? Is this effort consumer driven or industry driven? Where should you place your bets?

Jeff Colvin, in his book, Humans Are Underrated, What High Achievers Know that Brilliant Machines Never Will, says the soft skills of Empathy, Creativity, Communication, Collaboration, and Relationship are the critical 21st Century Skills. He believes the human factor will be more critical than ever. Humans are the value wedge.