The metaverse is still very much in its fledgling stages, but already it’s become the word on everyone’s lips when talking about the future of the internet. The technology promises to herald a seismic shift in how we work, play, communicate, and collaborate online, with emerging technologies like cryptocurrency, NFTs, blockchain, machine learning, and reality technology joining forces to create a groundbreaking ecosystem.

One of the most significant developments attached to the metaverse is the rise of virtual real estate, which has captured the attention of investors around the world as they bid to gain a stake in this brave new world.

The reason that metaverse real estate has taken off is because large institutions are already actively looking to build spaces online in which they can reach customers and resonate with new audiences. For many investors, the prospect of buying metaverse real estate, which is made accessible via NFTs, is a money-spinning investment that could see the value of their space increase exponentially as the metaverse becomes a reality.

However, like with all investments, there are many risks attached, and no virtual real estate should be bought without a significant level of research prior.

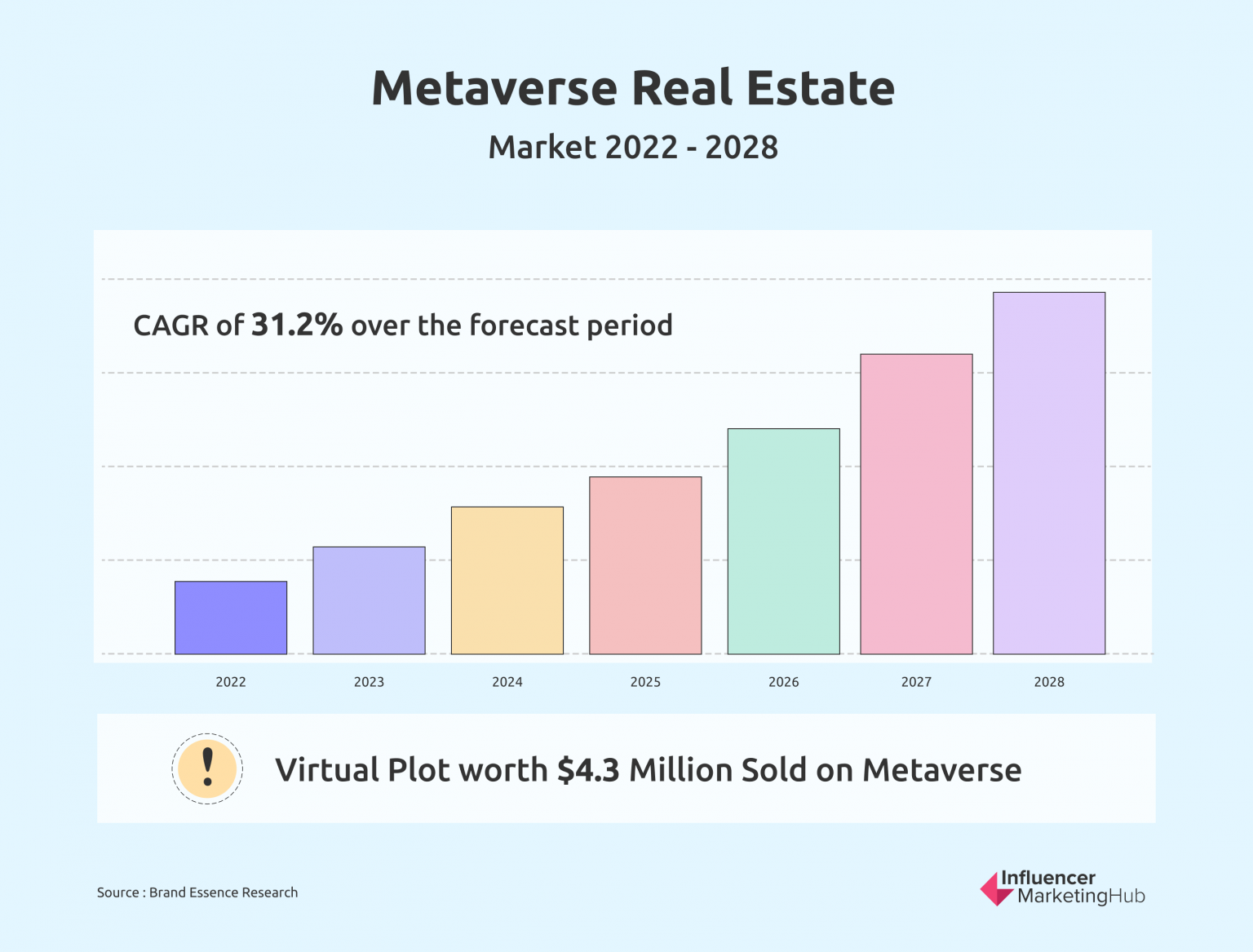

(Image: Influencer Marketing Hub)

As forecasts show, a compound annual growth rate (CAGR) of 31.2% between 2022 and 2028 indicates that there’s plenty of potential for investments made today to grow in value, and with a virtual plot of land selling for $4.3 million already, we can see that big money is already being thrown around by investors.

“People are already willing to invest heavily in “Internet properties”, including digital real estate, digital fashion, premium cars and the like. Global giants like Unity, Apple, Meta, Roblox, Microsoft, Nvidia have created their own metaverses and continue to invest,” says Maxim Manturov, head of investment advice at Freedom Finance Europe.

“Emergen Research analysts predict the metaverse market will grow to $829 billion by 2028 and Bloomberg Intelligence analysts predict it will reach $800 billion by 2024. Morgan Stanley estimates China’s metaverse market could be worth 52 trillion Renminbi (about $8 trillion) in the coming years,” Manturov adds.

However, it’s worth it for investors to understand the trends that are likely to emerge alongside the metaverse and how they may impact their respective investments. As we saw with the dotcom boom, an emerging technology that features a form of virtual real estate can carry many different ramifications across a range of industries. With this in mind, let’s take a deeper look into three things that investors should expect to see as the metaverse begins to take off:

Cryptocurrency and the Metaverse are set to go hand-in-hand

Just like physical real estate, virtual real estate will cost money — but what money will drive the market?

Today, the most popular metaverse ecosystems that allow users to buy property are built on the Ethereum blockchain, meaning that transactions are handled by the cryptocurrency, ETH. Ethereum’s influence on the metaverse can be seen in the frequency in which NFT projects are opting to use the digital currency to deal with purchases and sales.

As opposed to the more famous cryptocurrency, Bitcoin, Ethereum has a more functional blockchain and the capacity to host faster and more efficient transactions. This makes the coin the current front runner as the native currency of the metaverse, but in becoming dominant, the value of ETH could fundamentally change between now and in the coming years.

The value of cryptocurrencies can change dramatically based on market sentiment, meaning that a plot of land worth, say, 5 ETH today could be a different proposition entirely if the value of Ethereum rises significantly between now and five years down the line.

With this in mind, investors will need to look for real estate opportunities and opportunities in the price of Ethereum, too. By choosing to wait for dips in the cryptocurrency market before making purchases, the value of investments may stretch further.

The rule of location, location, location will still apply

The metaverse promises to be an interconnected space in which one click can transport users from one virtual neighborhood to another. So, just how important will location really be?

Sam Huber, founder and CEO of Admix, a metaverse advertising agency, believes that location may be pivotal in the functionality of the metaverse — depending on which platform becomes dominant in the future:

“Different platforms are solving it or trying to solve it in different ways. On one extreme, you have platforms where distance doesn’t matter at all, which is kind of currently the case on Sandbox because you can just basically click in the area that you want to go and go there directly,” Hubner explained.

“If the distance is not a problem, then technically you shouldn’t have areas that are much more expensive than others because you can always get anywhere, even if it’s at the edge of the map,” he added.

However, in the metaverse ecosystem, Somnium Space, for instance, jumping from one side of the map to another comes at a cost — encouraging more users to walk and bringing more value to different neighborhoods.

On top of this, it’s likely that we’ll see institutions buying into premium value areas to create functional virtual shopping districts where various brands are closer together for the ease of customers to navigate from one shop to another.

This implies strongly that we’ll see the metaverse mimic many real world locations where users will be able to enjoy a thriving central business district with high value locations whilst land on the outskirts will be considerably cheaper to buy.

Expect to encounter scammers

Safety in the metaverse will be a key concern for users and investors alike. Built on blockchain, which is an immutable digital ledger, the metaverse promises to be a secure place where property can be safely stored and correctly attributed to its rightful owner. However, this doesn’t mean that scammers won’t still attempt to steal your virtual assets.

Just like in the world of cryptocurrencies and NFTs today, phishing scams and attempts to deceive investors into giving up their properties will be rife throughout the metaverse – after all, it’s a place where cyber criminals can forcibly access vast fortunes in digital assets without having to leave their homes.

Recently, we saw an NFT investor lose $570,000 worth of assets in a trade offer for worthless PNGs of NFTs with a false verification mark printed directly on to the tokens. This form of elaborate deception can be expected to continue when it comes to ownership in the metaverse.

With this in mind, metaverse real estate investors must remember to remain vigilant at all times whilst getting to know the exciting world of the metaverse. Always conduct research and assume that anything which seems too good to be true generally is.

This column does not necessarily reflect the opinion of RealTrends’ editorial department and its owners.

Dmyrto is a London-based finance writer and founder of Solvid and Pridicto.