Brokers are concerned about changes to the size of the pool of real estate agents during 2023, with some predicting a large reduction in agent count in their markets. The more likely scenario is a gradual erosion of membership.

This article examines the relationship between average commission per member and the flow of agents into and out of the real estate industry using National Association of Realtors (NAR) membership data. The results show that income potential is a prime driver of people entering the industry, and a tight correlation occurs between average inflation-adjusted commission per member and membership growth. The paper also provides forecasts for 2023 based on NAR’s stable prices and a decline in existing home sales.

People enter new industries for a variety of reasons. The availability of other options certainly comes into play. As people move through different stages of life different careers have varying levels of appeal. However, in the case of a decision to become a real estate agent, income potential is likely the prime motivating factor. As we’ll see the average income level for real estate agents has a huge impact on the flow of people into or out of our industry.

Tight correlation between average commission and agents leaving business

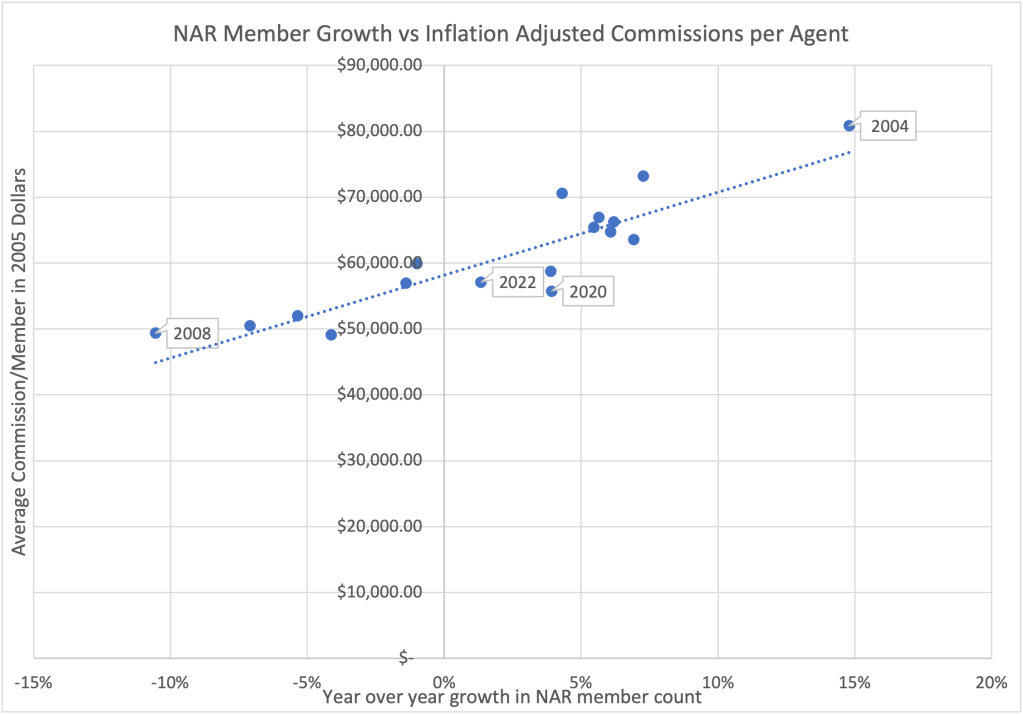

We analyzed the trend in NAR membership and compared it to inflation adjusted commissions per NAR member. We used the 2004 to 2022 time period to ensure that we included the last boom-bust cycle in real estate.

The results showed that a tight correlation occurs between average commission per member and the flow of agents into and out of the business.

When this average commission per member exceeded $55,000 per year in 2005 dollars, NAR membership tended to grow. The higher the average member commission, the higher the growth. At income levels below this, shrinkage in membership occurred.

Average commission per Realtor shouldn’t be confused with average agent income. Splits are not included and the business model has clearly changed over time favoring more income to agents.

Also, we are not factoring in the proportion of non-Realtor licensees and those who hold membership in NAR but do no business. The proportion of these last two may have shifted over time. Nevertheless, this shows that income potential is a prime driver of people into our industry and that the stable average commissions per member over the last few years has produced steady growth for NAR.

Forecasting 2023

Knowing the relationship between commissions per member allows us to forecast what 2023 likely holds for the agent pool. Using NAR’s forecast of stable prices and a decline in existing home sales to 4.78 million, and further assuming a 5% inflation rate, we can make a few forecasts for 2023. We can expect:

- NAR membership will drop to 1.5 million — a 3% decline.

- Inflation-adjusted, per-member commissions will drop a total of 5.7%.

- Current-year commissions per member will decline slightly in present dollars to $84,700.

- This will produce a continued slide in the number of sides per member down to 6.3. For comparison, this number was 9.0 in 2015.

Recently, several economists have forecast a more severe downturn that could see 2023 existing home sales fall below 4.0 million. Modeling a scenario where annual existing home sales fall to 3.9 million, accompanied by a 5% decline in home prices, predicts a steeper fall in NAR membership.

- NAR membership would drop to 1.3 million — a 15% decline.

- Inflation-adjusted, per-member commissions would drop a total of 15.1%.

- Current-year commissions per member will drop in present dollars to $76,311 (11%).

- Sides per member will fall to 5.9

While 15% seems modest, this would represent the largest percentage drop in the last 25 years exceeding the 11% drop from 2006 to 2007.

What does this mean for broker owners?

We can expect a shrinking, but not collapsing, pool of real estate agents. Given that production is highly skewed to high producers, this will yield more pain in the bottom half of the production ladder in the office.

We can expect to see more agents with second jobs and perhaps growth in teams as low-producing agents gravitate to team member positions. And indeed, this trend could end up being a significant driver of team formation and expansion. There will be a sorting out process similar to that for 2007-09 where more business will flow to fewer agents and agent pools will be realigned. Brokers who anticipate and actively manage this trend will gain share at the expense of those who don’t.

Data: NAR, US Federal Reserve, Statistia for historical average commission rates.

Rob Keefe is president of Relitix Data Science, a real estate brokerage data intelligence company.