In late June, Susan Gregory received an estimate for a new homeowner’s insurance policy on her 120-year-old St. Augustine, Florida property, after her previous insurer, United Property and Casualty, went insolvent earlier in the year. Gregory was shocked to find out that her yearly payment would go from $8,800 to nearly $36,000 if she signed on with the new company.

“I thought this was my forever home,” Gregory told First Coast News, which first reported the story. “It can’t be my forever home if I can’t afford it.”

And Gregory’s story is becoming commonplace in flood-prone areas of the United States, especially in Florida. According to Sandy Williams, an eXp Realty agent in Sarasota, homeowners’ insurance costs have doubled for many in her metro area (flood insurance costs have also risen dramatically).

“I do a lot with new construction and homeowners’ insurance is cheaper on new builds because they are brand new,” Williams said. “With material and labor shortages, and supply chain issues it is taking a year-and-a-half to two years to complete a property. A lot of my clients will get insurance quotes three months into the project and then about a year later they are getting their final quote. One of my recent new home buyers got their final quote on a property a 30-minute drive from the coast and it had gone up 40% from a year ago. This is one of the easiest parts of Florida to insure and costs have gone up over 40%.”

As soon as we find a house that our clients love and we think they are going to write an offer on it, we immediately reach out to an insurance agent to see the insurability of the house because it is becoming more and more of a problem.

Todd Armstrong, a compass agent in san diego

Since early 2022 many insurers and reinsurers who back insurance policies have either left the state, scaled back operations or fallen into insolvency. As a result, the Insurance Information Institute estimates that Floridian homeowners are on track to pay an average of $4,000 a year in insurance in the near future, nearly three times the U.S. average. The rising costs and lack of availability of homeowners insurance has forced many homeowners and buyers to turn to Citizens Property Insurance Corporation, the state’s insurer of last resort.

“Right now, Citizens is the largest insurance company in Florida, and they are supposed to be for the last resort,” said Matthew Ekberg, an agency owner at the St. Petersburg, Florida-based insurer Erb and Young. “We are doing a lot of Citizens policies, unfortunately, because for most properties the next best option is maybe $2,000 to $4,000 more a year.”

The increased severity of hurricanes and the rising costs of repair and reinsurance have driven some insurers to insolvency, and convinced others to end offering homeowners insurance coverage in Florida.

But Ekberg said there’s also another reason – the roofing hustle.

“A number of years ago, roofers started to knock on people’s doors after storms and pretty much promised them that they could get them a free roof,” Ekberg said. “They would target the old looking shingle roofs, and if the claim was denied they would have an attorney in their back pocket. So they would file a lawsuit if the claim was denied, and, at the threat of a lawsuit, the insurance companies would just roll over and pay the claim. Word started to spread about this and then everyone was doing it, costing insurers millions.”

In addition, litigation costs on insurance claims have risen dramatically in the wake of a 2017 State Supreme Court decision that allowed courts to award plaintiff’s attorneys up to 2.5 times their hourly billing rate should the court rule in favor of the policy holder. The number of property insurance lawsuits in the state skyrocketed – in 2023 alone, the state is on track to have more than 130,000 property policy lawsuits, accounting for 79% of all property insurance lawsuits filed nationwide.

Several pieces of legislation were passed in Florida last year that should ease rising insurance costs, including one that reduces “frivolous litigation,” another that reduces the amount of time policyholders have to submit a claim to 12 months, and scrapping the assignment of benefits, in which a homeowner signs insurance benefits to a third-party like a contractor.

Still, there’s no denying that from coast to coast, hurricane risks and flash floods are becoming more costly.

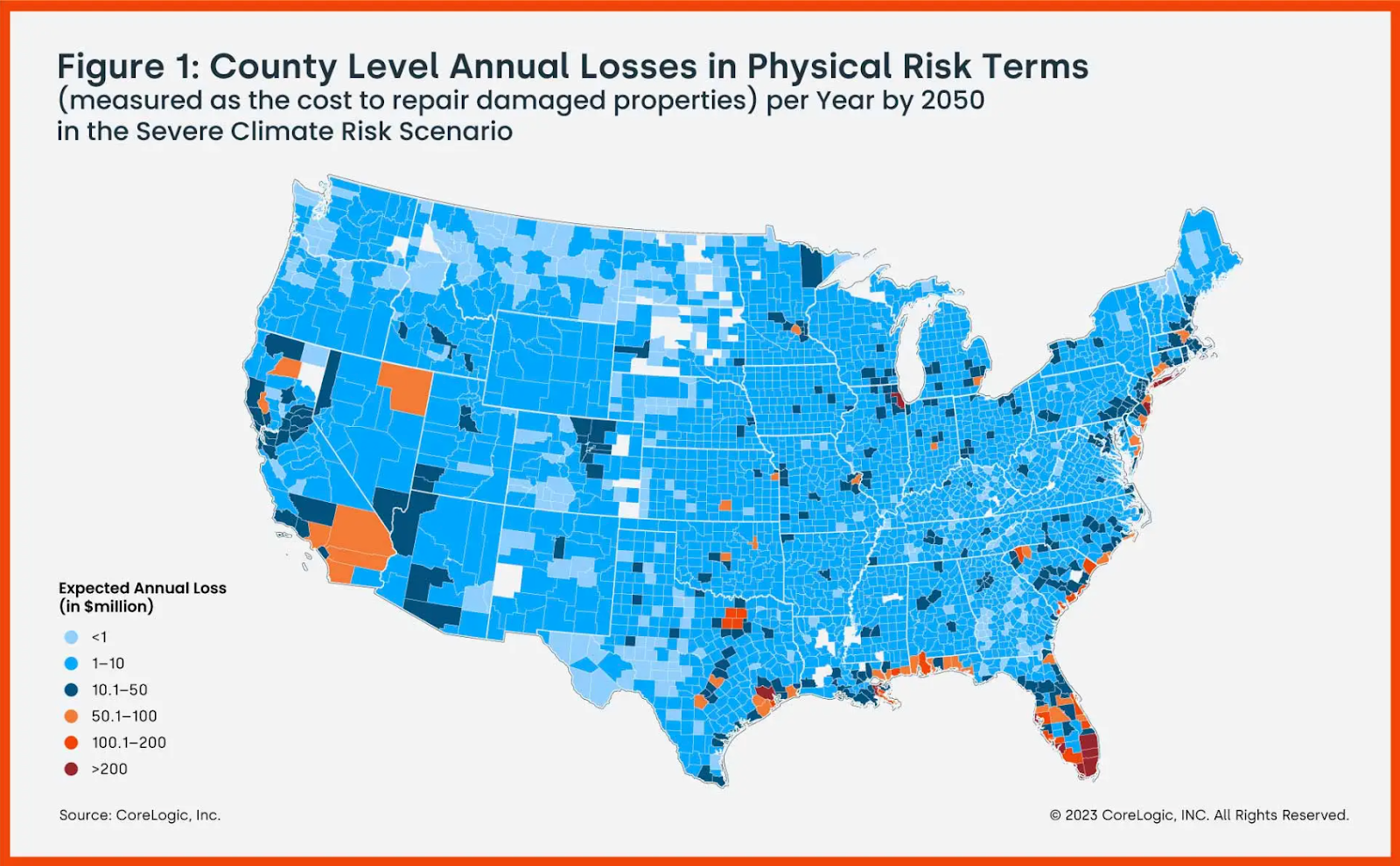

According to an analysis using CoreLogic’s Climate Risk Analytics: Composite Risk Score (CRA), Florida’s Miami-Dade County is forecast to have the highest climate change-related risk in the United States, with estimated annual losses of $988 million per year through 2050. Louisiana’s Jefferson Parish ranks second, with $476 million in annual losses, followed by Florida’s Palm Beach County, where annual loss estimates are $442 million.

The risk in California is too hot for insurers

Florida may be the tip of the spear, but California, America’s most populous and prosperous state, is also facing a homeowners insurance crisis. In the past six weeks, State Farm and Allstate announced that they would no longer be accepting new applications for business and personal lines of property and casualty insurance in California.

In announcing their departure from the Golden State, the two major insurers cited the increased wildfire risks in the state and rising construction costs.

“State Farm General Insurance Company made this decision due to historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging reinsurance market,” the company wrote on its website.

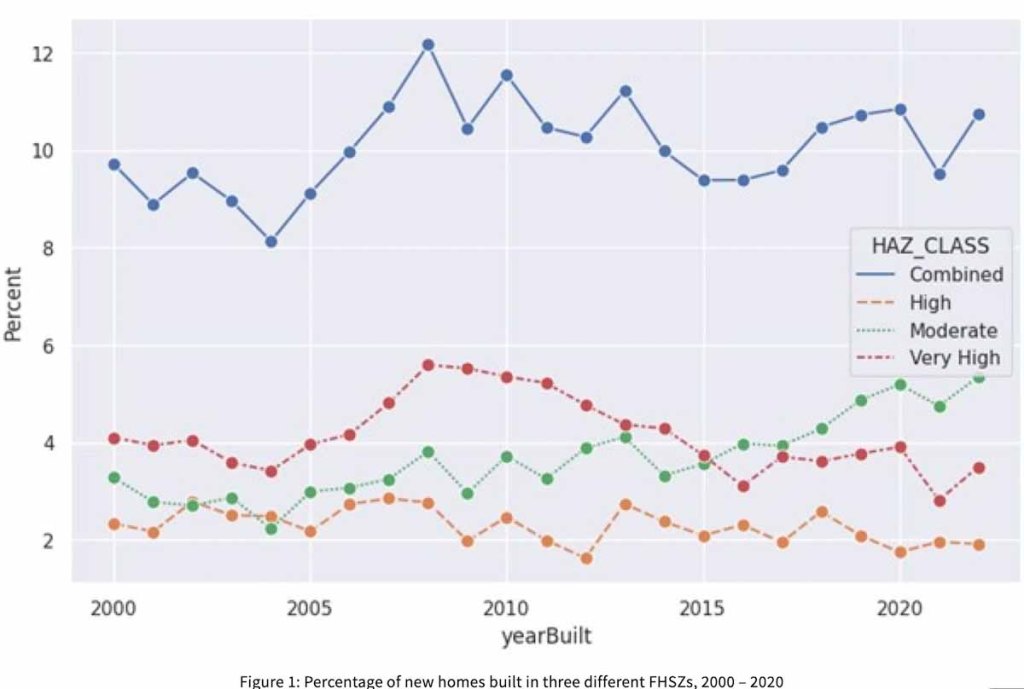

The III said 1.265 million California homes were at risk for extreme wildfires in 2022, more than 400,000 than the next highest state. However, data from CoreLogic shows that the number of homes built in the Very High Fire Hazard Severity Zone (FHSZ) has declined from 5.5% to 3.5% over the past 15 years, but building in Moderate FHSZ has nearly doubled since 2008, and while the fire risk in this zone is less severe, it is still present.

Since the start of 2023, CAL FIRE and the US Forest Service have recorded 2,584 wildland fires in the state, which have burned a total of 8,418 acres.

“The number of acres burned in California has grown steadily in recent years, as more people are moving into fire-prone areas of the state,” the III said in a statement on the companies’ departures from California. “More homes in harm’s way — combined with rising costs of repairing or replacing houses either damaged or lost to fire — leads to increased insured losses.”

With insurers leaving the state, the California FAIR Plan, the state’s insurer of last resort, saw enrollment jump to 272,846 homes in 2022.

“Year over year, I have written more and more business with the California FAIR Plan,” said Paul Scalone, a San Diego-based Compass agent and the owner of Dignified Insurance Services. “When we start getting into the catastrophe and wildfire conversation with homes, and homes being harder to insure, over the course of the last few years I have seen a drastic uptick in the number of policies that I have had to write with the FAIR plan.”

Like in Florida, insurers in California are facing more than just climate related challenges. In 1988, California voters approved Proposition 103, which allows the state insurance commissioner to reject proposed rate increases and order refunds be paid to policyholders. Though the policy has been credited with saving consumers billions of dollars, the insurance industry says it comes at the expense of accurate underwriting and actual pricing risks.

“They have to submit requests to the [state] department of insurance to raise prices and that take a lot of time to review, so carriers want to leave,” Scalone said. “Everything is so expensive and they can’t move their rates up fast enough to keep up with the demand for insurance and reinsurance.”

Impact on home values and sales

In the meantime, real estate agents in Florida and California are concerned that the rising homeowners’ insurance costs in their states will have a negative impact on homeownership.

Entry level homebuyers are getting hit hardest.

“If we start looking at debt-to-income ratios when they are trying to get a loan, before it was easy to assume if they are buying a small home or a condo that it would be $100 a month for homeowners’ insurance, but that is not the case anymore,” Scalone said. “A lot of first-time buyers can’t afford to buy in San Diego proper, so they look out in Alpine or Escondido, where the houses are a bit cheaper, but now you are looking at insurance costing way more a year and if you are in a fire zone, you might not even find a carrier that will cover you.”

Additionally, wildfire proofing or building a wildfire resistant home in California can cost an additional $2,800 to $27,100, according to Wildfire Today, an added financial burden many homeowners and buyers cannot easily afford.

In Florida, Jacob Watkins, the broker-owner of Corcoran Reverie in the state’s 30A region along the Gulf of Mexico, is witnessing a similar trend.

“Prior to now we never really had to pay all that much attention,” Watkins said. “Insurance was typically not a big factor in the decision making process, but given the cost now and even the availability of what properties can easily be insured and what cannot is definitely a factor in what properties our customers are looking at and considering.”

Agents in both California and Florida said that while homebuyers are increasingly highlighting risks of flooding or fire in their home search parameters, climate-related concerns aren’t stopping many would-be buyers or existing homeowners.

“I don’t think we will see a flood of people leaving or anything like that,” Anne Marie Würzel, an Orlando-based Mainframe Real Estate agent, said. “People really do like to have this Florida lifestyle and people that are on the coast inherently know the risks of living there and choose to do so anyway because the ocean is gorgeous, and people love the beach and people will continue to go to the beach whether or not they live on it. Florida beaches are just a huge attraction for people, and I don’t really see how climate change will impact that.”

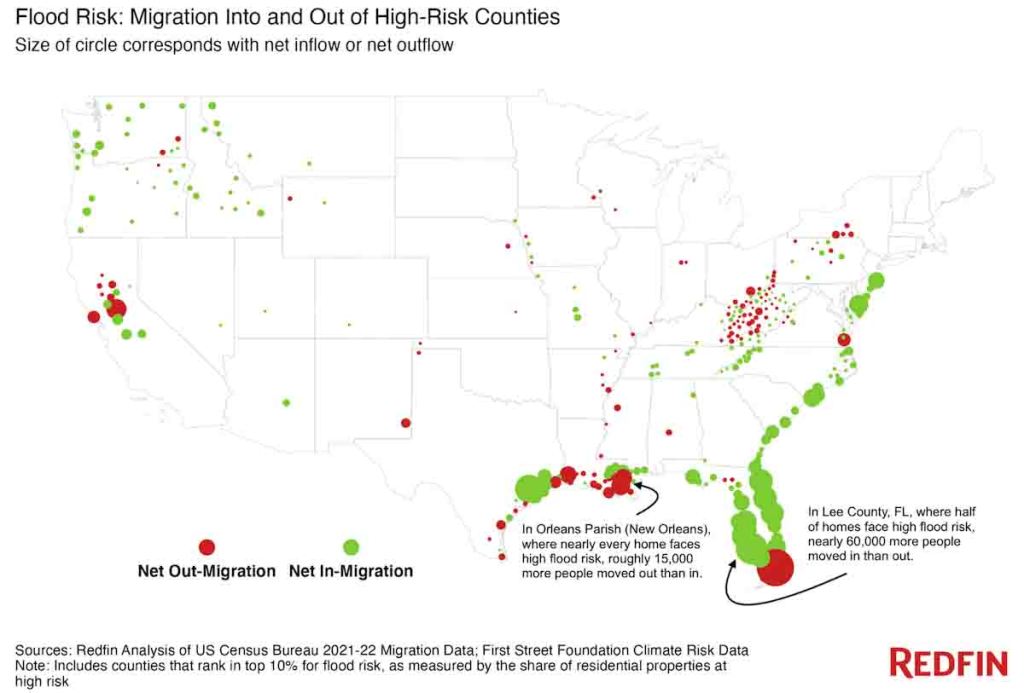

According to Redfin, in the past two years, nearly 60,000 more people moved into than out of Lee County, FL, which includes Fort Myers and Cape Coral, and was slammed by Hurricane Ian in September. That’s the largest net inflow of the 306 high-flood-risk counties Redfin analyzed, and represents an increase of about 65% from the prior two years. Florida is home to eight of the 10 high-flood risk counties that experienced the largest net inflows of people over the past two years.

Agents in California similarly don’t believe climate risks will stop people from scooping up houses.

“We haven’t really seen climate risks impact transactions too much yet, but I am guessing it will come up in the future,” Tracy Do, a Los Angeles-based Coldwell Banker agent, said. “Right after something occurs like a big fire or a week of bad air quality in Los Angeles then people are more concerned, but after it is out of the news then we don’t hear as much about it from buyers.”

Again, data from Redfin supports Do’s assertion. Riverside County, which is home to nearly 600,000 properties facing high wildfire risk, has experienced a net migration increase of 40,000 people over the past two years.

“The consequences of climate change haven’t fully sunk in for many Americans because oftentimes, homeowners and renters don’t foot the whole bill when disaster strikes,” Daryl Fairweather, Redfin’s deputy chief economist, said in a statement. “Insurers and government programs frequently subsidize the cost of rebuilding after storms hit, and mortgages mean homeowners are ceding some risk to lenders—especially if their house goes into foreclosure after a storm.”

Agents get proactive

While just a handful of buyers are using climate risks to narrow their search areas, many others are using insurance costs to pinpoint areas within their budgets. In order to prevent unexpected sticker shock, agents like San Diego-based Compass agent Todd Armstrong work with an insurance broker to price out homeowners’ and fire insurance costs in the different fire zones in a homebuyer’s preferred home search areas.

“As soon as we find a house that our clients love and we think they are going to write an offer on it, we immediately reach out to an insurance agent to see the insurability of the house because it is becoming more and more of a problem,” Armstrong said.

In addition to impacting homebuyers, in Florida, Williams believes rising insurance costs may lead to lower home values.

“If you look just three miles inland, insurance is a lot cheaper, so I think what you are going to start to see is the resale values of properties hit hard by rising insurance costs are going to drop,” Williams said. “Someone is going to have to pay for these rising costs one way or another and I think the sellers are going to start taking a hit on some of this because it becomes less desirable to live there.”

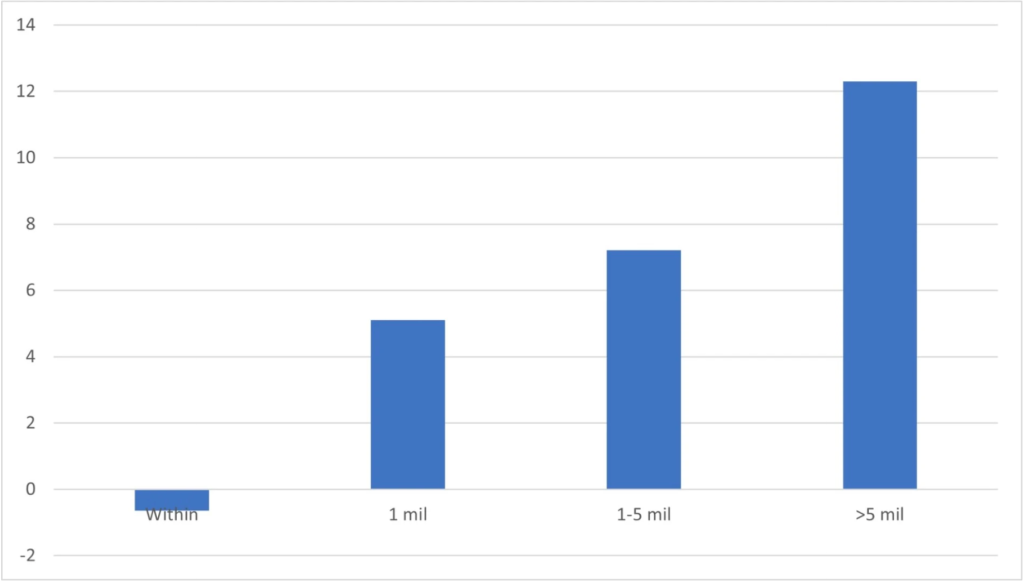

In California, CoreLogic data shows that the wildfires themselves have already had a negative impact on property values. In a study examining the 19 counties impacted by the five largest fires recorded in the state’s history (all of which occurred in 2020), between June 2021 and May 2023, the price of properties in the fire perimeter decline 0.64%. In contrast, the average price appreciation during the same two year time period for the state as a whole was 12.3%.

Agents in California, however, are not too concerned about property values in harder-to-insure areas. They are more worried about how challenging it is becoming to insure a property.

“It is definitely a lot more difficult now than it has been in the past,” Scalone said. “The underwriting requirements for homes are getting a lot more strict. California still has over 100 carriers, but they are scrutinizing the risks a lot more.”

Scalone said he recently wrote a policy for clients buying a home in Claremont, the Serra Mesa area of San Diego, which is an urban environment.

“A year or two ago that would have been a slam dunk, no questions asked,” he told HousingWire. “But it probably took me two or three weeks of back and forth with multiple carriers, answering an array of different questions and submitting documentation and photos of the home before we got a carrier to agree to take the risk. It is just a sign of the times here in California.”