Single Women More Likely to Be Homeowners Than Single Men

Lending Tree study found single women are outpacing single men in homeownership.

In much of the United States, single women are outpacing single men when it comes to homeownership. This trend may be somewhat surprising, given the average woman in the U.S. only makes 80% of what the average man does. Nonetheless, the data clearly indicates that single women are more likely to own a home than single men are.

To determine the number of single homeowners in each metro area, LendingTree online loan marketplace analyzed data from the 2017 American Community Survey. Researchers defined single homeowners as single men or women who live in owner-occupied homes.

Researchers found that in all of the 50 largest metropolitan areas, single women own more homes than single men do. On average, single women own more than 70,000 more homes in metro areas than single men do.

Key Findings:

- Single women own considerably more homes than single men do. On average, single women own around 22% of homes, while single men own less than 13% of homes.

- Oklahoma City was the metropolitan area where single men own the largest share of owner-occupied homes, at 16%. Even though single men own a greater proportion of homes in Oklahoma City than they do elsewhere in the country, they still own fewer homes than single women, who own 24% of residential properties in the area.

- New Orleans was the metro area where single women own the largest share of owner-occupied homes. In this area, single women own nearly twice as many homes than single men do: 27% compared with 15%.

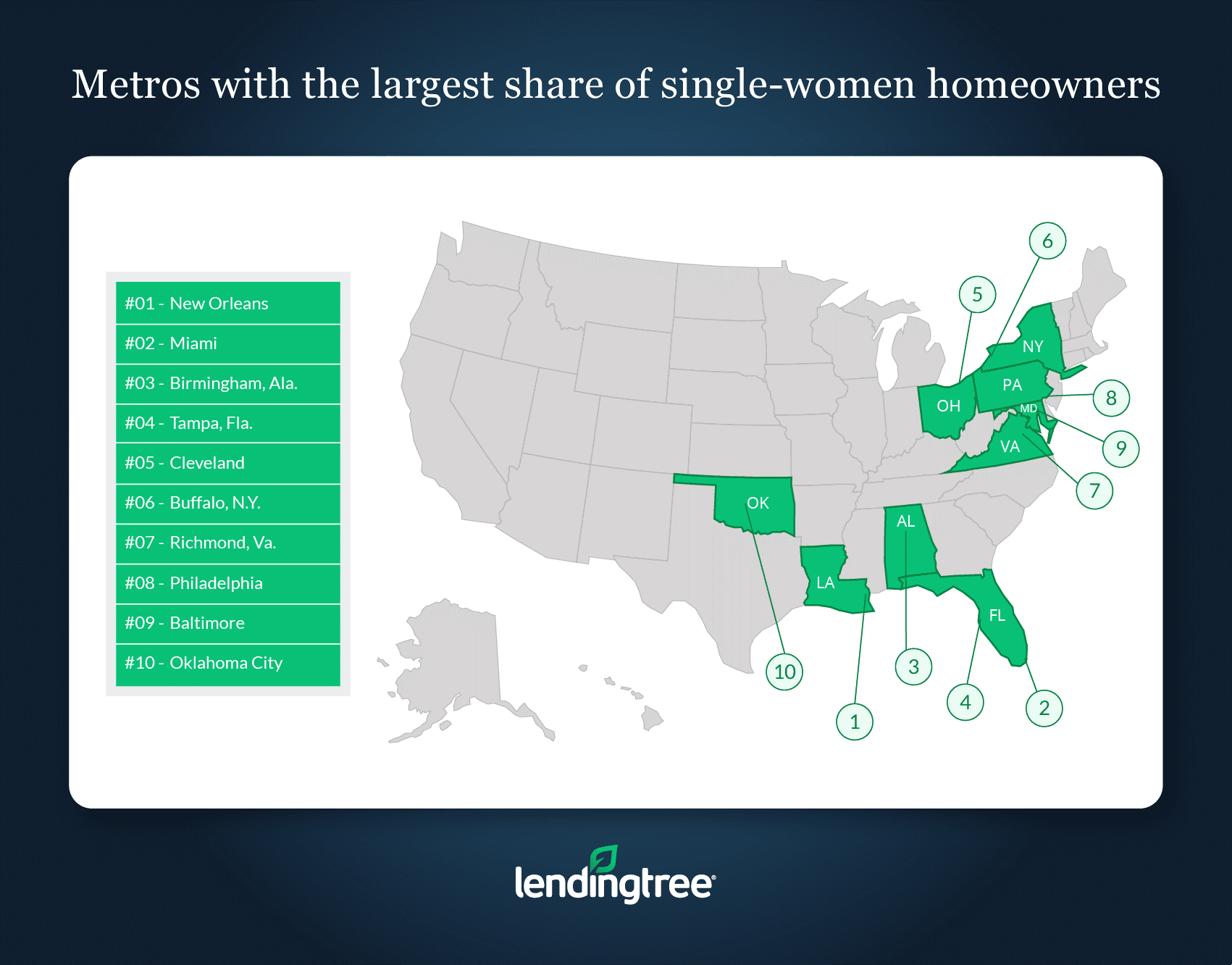

Metros with the largest share of single-women homeowners

New Orleans

Owner-occupied households: 299,556

Households owned and occupied by single women: 27.08%

Households owned and occupied by single men: 15.47%

Gender gap between single homeowners: 11.61 percentage points

Miami

Owner-occupied households: 1,252,418

Households owned and occupied by single women: 26.81%

Households owned and occupied by single men: 14.22%

Gender gap between single homeowners: 12.59 percentage points

Birmingham, Ala.

Owner-occupied households: 298,673

Households owned and occupied by single women: 25.44%

Households owned and occupied by single men: 13.75%

Gender gap between single homeowners: 11.70 percentage points

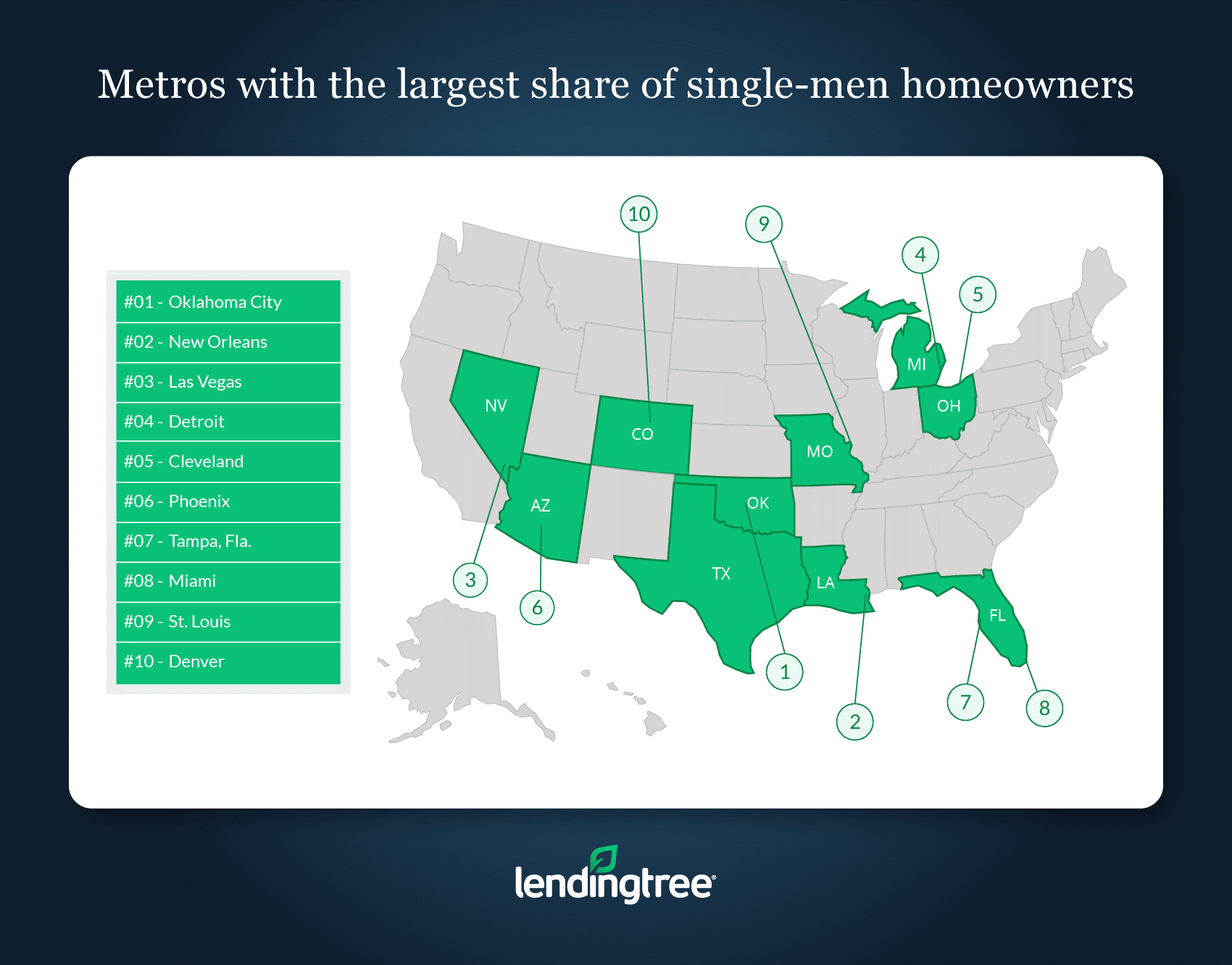

Metros with the largest share of single-men homeowners

Oklahoma City

Owner-occupied households: 324,907

Households owned and occupied by single men: 15.52%

Households owned and occupied by single women: 23.78%

Gender gap between single homeowners: 8.27 percentage points

New Orleans

Owner-occupied households: 299,556

Households owned and occupied by single men: 15.47%

Households owned and occupied by single women: 27.08%

Gender gap between single homeowners: 11.61 percentage points

Las Vegas

Owner-occupied households: 64,821

Households owned and occupied by single men: 15.30%

Households owned and occupied by single women: 21.03%

Gender gap between single homeowners: 5.72 percentage points

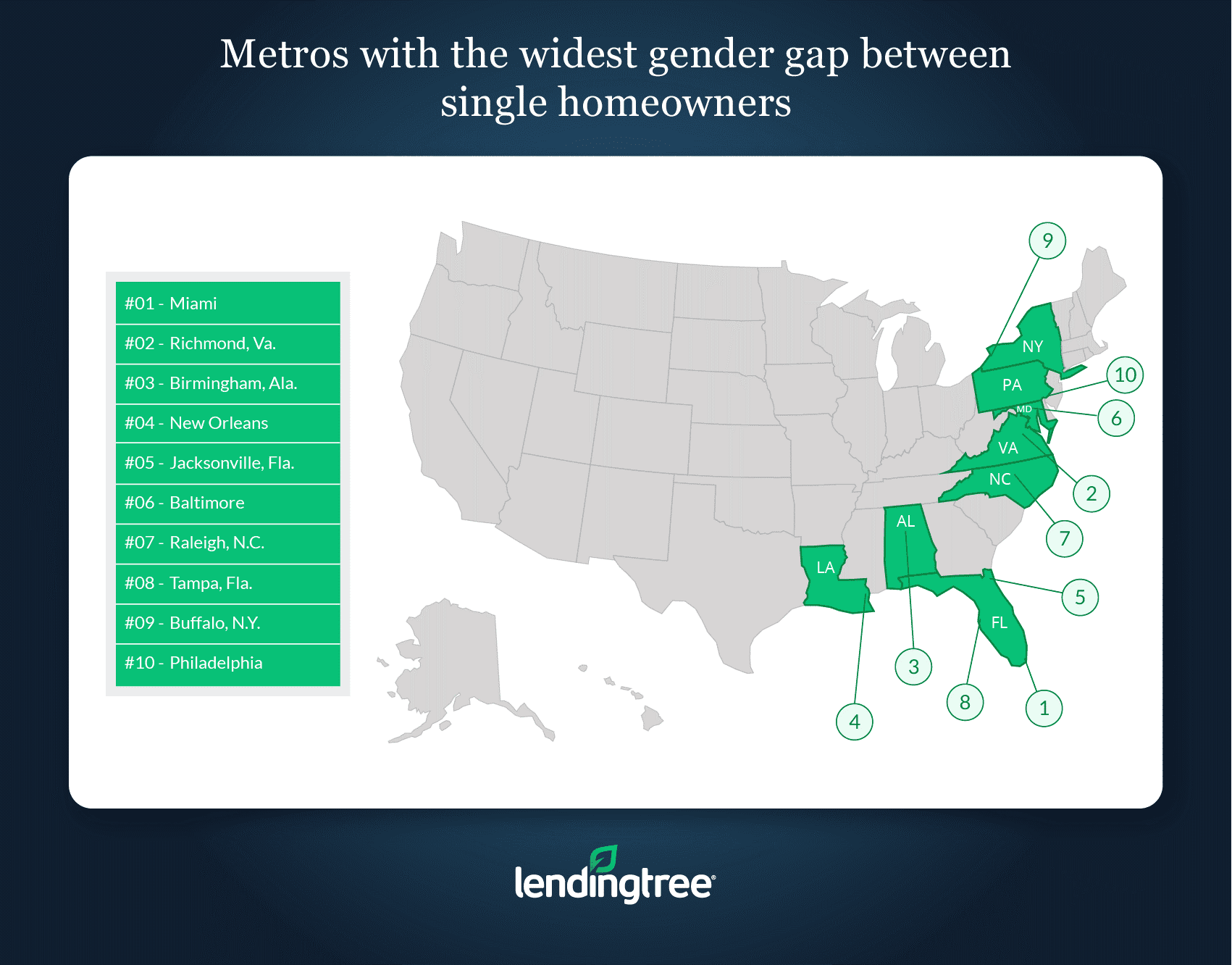

Metros with the widest gender gap between single homeowners

Miami

Owner-occupied households: 1,252,418

Households owned and occupied by single women: 26.81%

Households owned and occupied by single men: 14.22%

Gender gap between single homeowners: 12.59 percentage points

Richmond, Va.

Owner-occupied households: 319,197

Households owned and occupied by single women: 24.19%

Households owned and occupied by single men: 24.19%

Gender gap between single homeowners: 12.46 percentage points

Birmingham, Ala.

Owner-occupied households: 298,673

Households owned and occupied by single women: 25.44%

Households owned and occupied by single men: 13.75%

Gender gap between single homeowners: 11.70 percentage points

Methodology

LendingTree used the U.S. Census Bureau’s 2017 American Community Survey with 1-Year Estimates to conduct this research. The survey looked at several different aspects of households in the United States. For the purposes of this report, LendingTree only focused on owner-occupied housing units. As the name implies, these homes are occupied by the people who own them, and not by people like renters.

To determine the percentage of homeowners who were either single men or women in an area, Lending Tree divided the number of homes occupied by either single male or female homeowners by the total number of owner-occupied homes in an area. It is important to note that these percentages do not add up to 100% because there are other types of homeowners in an area, like married couples.

To find the “Homeownership gap (number),” researchers simply subtracted the number of homes owned by women in an area by the number of homes owned by men in that same area. Similarly, they subtracted the percentage of homeowners who were women by the percentage of homeowners who were men to find the “Homeownership gap (percentage points).”

More data on U.S. households, as well as a breakdown of the ACS’s methodology can be found by using the United States Census Bureau’s American FactFinder.