As we polish the silver for the spring buying season we have to ask, will anyone show up for dinner? Our best few months of the year typically are the ones when flowers bloom and the sun is warming the sidewalks of our neighborhoods. In the south we are in the spring buying season already and although the tables are set and dinner is cooked, it’s getting cold.

The market was hit with a one-two punch — inventory is down and mortgage rates are rising.

Look at a home in Charlotte, North Carolina in 2019. A three-bedroom, three-bathroom home with 2,400 square feet in South Charlotte has a $400,000 list price. The borrower has 20% to put down ($80,000) and get a conventional 30-year loan of $320,000.

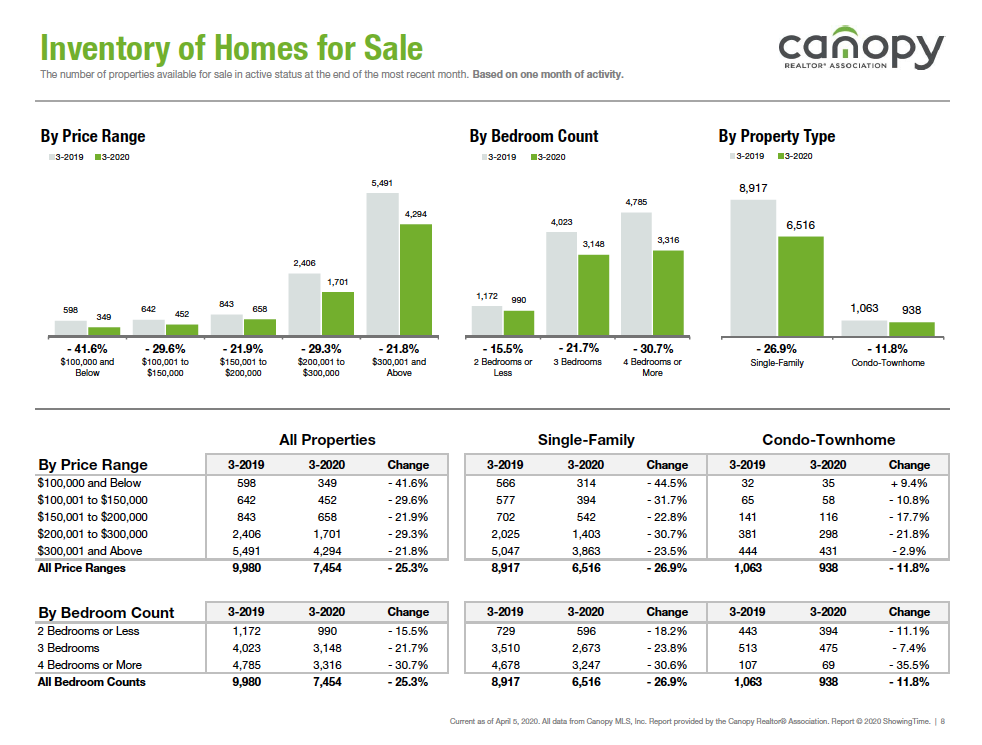

Let’s consider inventory of SFR homes. Inventory of homes in March 2019 from carolinarealtors.com there are 1,923 homes available in the price range of $350,000 – $500,000.

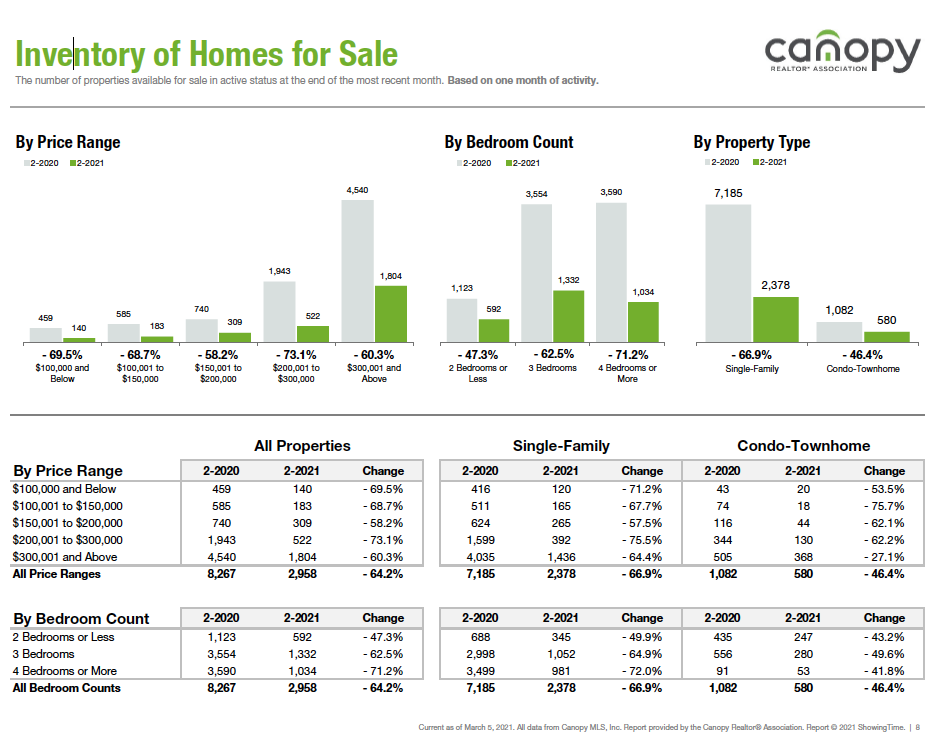

Properties available to purchase in this range of inventory in 2021 dipped to at 538 units. Here’s 2021 data.

Here’s the catch — today there are even fewer homes in inventory and $400,000 homes are nearly non-existent. The market has gone from 1,923 units to 438 for a home in this price range in just two years. 2022 numbers are even lower.

Let’s look at the two industries trying to navigate this storm

This home at $400,000 in 2019 had a rate of 2.8% and a loan of $320,000 with $80,000 down. Not including taxes and insurance, the P&I would be $1,315.00. That is cheaper than rent and easy to afford for most buyers.

Let’s fast forward to March 2022 and look at this same property. Current sales price with multiple bids and low inventory has buyers at a $550,000 price tag. What changes for the buyer? The down payment is now $110,000. The loan is now $440,000 at 20% and the rate is 4.8%; that gives us a payment of $2,309. That is a 58% increase in payment.

If one changes but the other doesn’t, we probably could see a buyer find a way to make it work, but this starts to add up when they both hit a buyer at the same time. People who prequalified for a loan near the end of 2021 may no longer qualify for this home in 2022 because the rate, down payment and price has gone up so much.

The loan they now qualify for is a house that is harder to find and has more bidders. Down payments that increase by tens of thousands is a shock for people who have planned for years and saved to put $40,000 away now — finding that is only 10% down and that rate has a HIGHER payment still.

Mortgage apps are down

Mortgage companies are laying off staff because applications are down between 40% to 55%. With rates increasing there isn’t any refinance business and currently purchases are over 51% of mortgage business.

Mortgage companies also are aggressively competing for a small number of buyers who are rate sensitive.

Meanwhile the agent who has a house listed is in the catbird seat with this line hungry to make an offer. Each person in line has Realtor representation as well, but only one gets the deal. How many came with an FHA 3% down or a VA loan that is 0% down and are not considered by the seller at all? How many have an old approval that was from January when rates were in the mid 3% range?

How many buyers will walk away?

The table is set as the Fed meets to potentially raise rates once again. How many of the people in line walk away because the rate makes this house too much to put a down payment? Changing their loan options or disqualify them entirely? How many never come to dinner at all?

If we look at this as two separate industries, we see one punch, and it is one that we have been through before. Realtors have seen buyer and seller markets and loan officers have seen high and low rates. We’ve all survived.

Today, the butlers stand by the door and have placed the first course at each seat. The wine is open and ready, the chefs have started plating the meat and even have deserts chilling. The table is waiting but will anyone show up?

Mortgage companies are downsizing, and real estate sales volume is down. Both are looking at pipelines as keeping the doors open. All sales meetings are looking for that big buying season to come, and it may not. What, if anything will happen as 2022 continues?

BJ Witkopf is a mortgage specialist with Assurance Financial.

This column does not necessarily reflect the opinion of RealTrends’ editorial department and its owners.

To contact the author of this story:

BJ Witkopf at bj@witkopf.net

To contact the editor responsible for this story:

Tracey Velt at tvelt@realtrends.com