Some people inherit their millions; others build companies or participate in sound investment strategies. Not into any of those? Just buy a house in an emerging market and wait comfortably for its value to surge past the $1 million mark.

Property Shark got curious and wanted to see how many people became millionaires by selling their homes since the turn of the century.

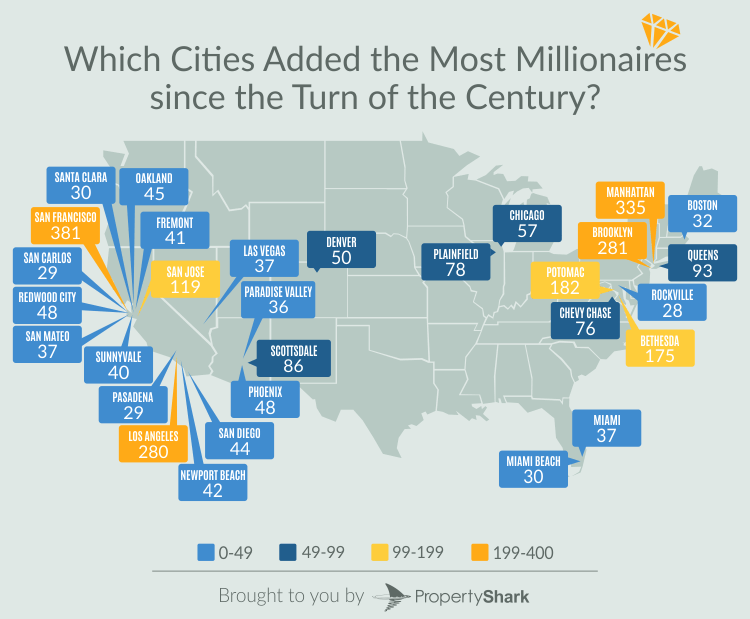

The analysis showcases 31 cities (it’s a ‘top 25’ but there are some ties) in which the most homeowners became millionaires just by buying a home sometime before 2001 for less than $1 million and selling it after 2001 for $1 million or more. They focused on the real estate aspect in our study, not including the financial status of the homeowners and other wealth factors.

Here are some of the key takeaways:

- After 2001, 381 people became millionaires just by selling their homes in San Francisco;

- Although home to twice the population of SF, Manhattan came in second, adding 335 millionaires;

- It’s almost a tie between L.A. (280) and Brooklyn (281), with Brooklyn squeezing in an extra millionaire;

- Silicon Valley cities in our list added a total of 332 millionaires;

- Four small cities on the outskirts of Washington, D.C., added 461 millionaires since ’01.

Real estate is an investment choice that has made countless people millionaires; however, success is not always guaranteed. You can buy the right home, at the right time, in the right market and dismiss the possibility that someday you might sell it, but if the need arises and selling becomes an option, the market’s condition will determine how much money you’ll get for a property that you bought 10 or 20 years ago.

Methodology:

The number of millionaires for each city was calculated by looking at homes that were purchased before 2001 for less than $1 million and resold by the same person after 2001 for $1 million or more. All residential transactions (single-family homes, condo and coop units) have been included and we did not take into account if a transaction was all cash or financed through a mortgage agreement. The stats on population for each city were extracted from Census, 2016 dataset.

We only focused on the real estate aspect in our study, not including the financial status of the homeowners and other wealth factors, such as income and savings, before or after the purchase of the homes. The analysis revolves strictly around the sale of the homes that made its owners $1 million or more at the time of the sale.