Pro Teck Valuation Services’ monthly Home Value Forecast uses a number of leading real estate market-based indicators to report on activity in the single-family home markets in the U.S., and concludes the market is slowing down.

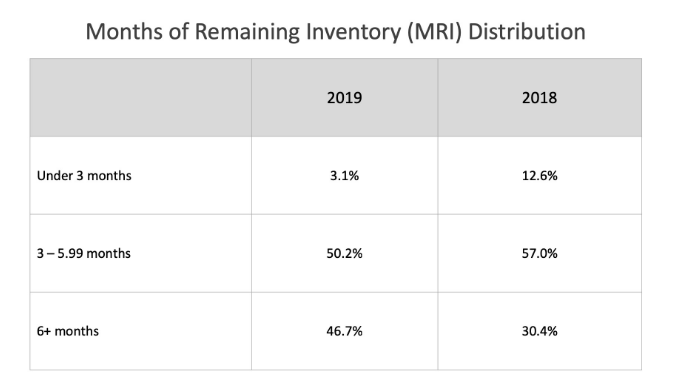

Pro Teck Valuation Services’ monthly report of housing inventory is showing an increasing number of markets that have a balanced supply, which is good news for buyers. A key measure, Months of Remaining Inventory (MRI), is calculated by dividing the number of households on the market by the number that sell every month.

Last year, 12.6% of markets had MRIs below three months, which is decidedly a seller’s market. That percentage has dwindled to 3.1% of the markets today, says Pro Teck. The seller’s markets are:

- Boise, Idaho

- Tacoma-Lakewood, Wash.

- Olympia-Tumwater, Wash.

- Denver-Aurora-Lakewood, Colo.

- Chico, Calif.

- Bremerton-Silverdale, Wash.

- San Jose-Sunnyvale-Santa Clara, Calif.

The good news, says Pro Teck, is that two-thirds of the metros it tracks have Months of Remaining Inventory between four and eight months, the range normally accepted as a healthy and balanced housing market. Pro Teck notes that the market with the most momentum at the moment is Washington, D.C., and its surrounding suburbs, including Alexandria, Va., where Amazon will locate its HQ2. Price appreciation in the region is highly correlated with employment gains and should continue as Amazon’s presence increases.

The report showed a significant increase in markets where Months of Remaining Inventory exceeds six months: In 2018, that percentage was 30.4%; in 2019, it is 46.7%.