Brokerage Return on REVENUE

Brokers have to get creative to stay profitable.

Continually declining retained company dollar (CO$) has been all the talk in the residential real estate industry. The days of 30%+ retained by the brokerage is all but a distant memory, and most firms are faced with trying to figure out how to function in a sub-20 percent environment.

Brokerage firms have been dealing with a steady decline in retained CO$ for years, and the rate of decline has yet to flatten out. Since 2012, we’ve seen the national average for all brokerage types fall by a staggering 34 percent!

Given this downward trend, brokerage firms have to be creative to remain profitable. Some have struggled, but most have stayed true to their savvy entrepreneurial spirits to keep their bottom line in the black. At REAL Trends, we track this bottom line performance via our Benchmark Report. As you can see, firms have so far successfully combated the retained CO$ woes.

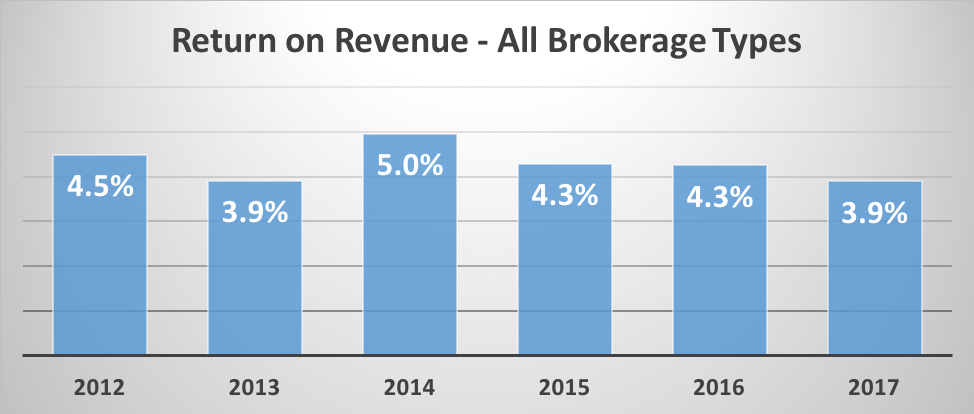

Specifically, our Benchmark tracks Return on Revenue (ROR), which is calculated by dividing net income (after adjustments) by gross revenue. ROR is a pure measure of profitability, primarily the owners’ yield. On average, ROR is not as high in the real estate industry as it is in other industries, but one can still make a good living running a brokerage firm.

Brokerages Are Adapting

Interestingly, ROR has only moderately declined since we’ve been tracking it, down 12 percent since 2012, which is just a fraction of the rate of descent of retained CO$ over the same period. Firms are figuring out how to adapt to this environment.

We’re able to see how many of these firms are adapting via our consulting work, and there are some common themes. Above the line, they are combating higher splits with various transaction fees. Though these fees tend only to cover a fraction of what they need to, every little bit counts.

Most of the adaptation is happening below the line via managing operating expenses. Brokerage firms have a lot more control over operating expenses and are cutting back where they can to maintain ROR.

Another way some firms are battling retained CO$ compression is the addition of ancillary services. Not all brokerages are large enough, operate in the right jurisdiction, have the capital or the wherewithal to develop this kind of an income stream, but some are having great success in the mortgage, title, escrow, insurance, and property management arenas.

One more thing to keep in mind on this ROR trend is it’s an average for all brokerage types. Not surprisingly, ROR figures do differ between commission plans. Graduated, 100 percent and Capped Commission plans, for example, see their numbers vary widely according to our calculations.

The bottom line is, despite continually slipping retained company dollar, the returns we see in this industry remain relatively steady. Brokerage firms are forced to be creative to survive in this environment, and the good ones are continuing to find a way to thrive.