The biggest real estate tech companies — Zillow, Compass and Opendoor — have set their sights on agent commissions as a source of revenue and profit growth.

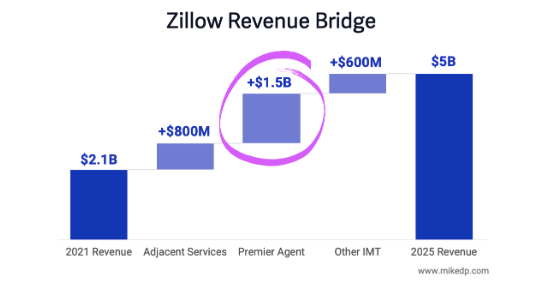

Why it matters: Agents remain the backbone of the industry, generating around $100 billion in commissions annually. That commission pool is a rich target for big tech companies to tap into. Zillow’s new strategy (Zillow 3.0: Back to Basics) is centered on extracting an additional $1.5 billion from agents by 2025, for a total of $2.9 billion annually.

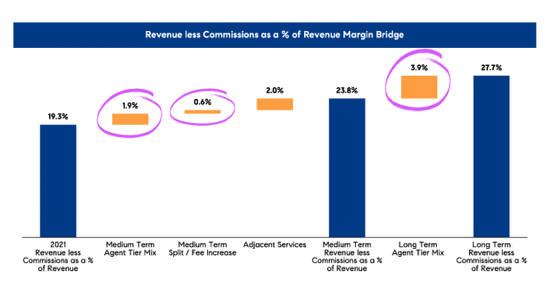

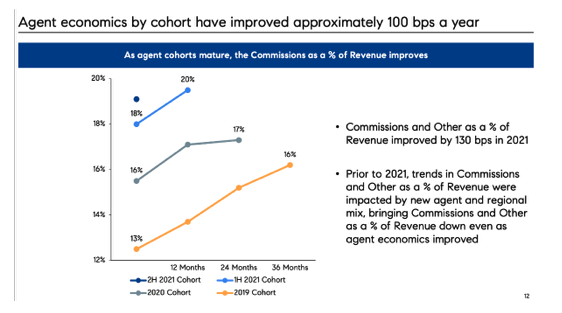

Compass wants to pay agents less. In its own words, Compass has a demonstrated track record of “improving economics with agents” of 1% per year.

- Compass provides multiple slides that highlight its plans and ability to reduce commission splits paid to its agents over time.

In other words, if you’re a Compass agent, the company’s plan for profitability hinges on reducing your commission split over time.

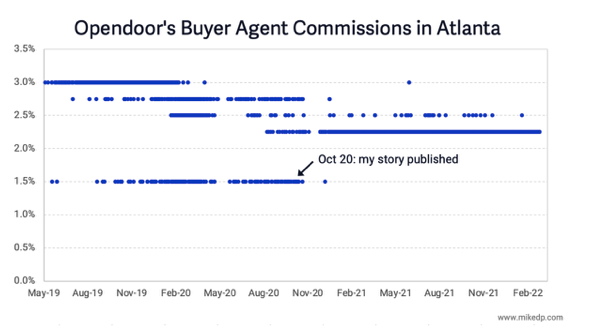

Opendoor continues to use its scale to push buyer agent commissions — one of its biggest expenses — lower.

- In Atlanta, Opendoor has experimented with buyer agent commissions ranging from 1.5% to 3%, having finally settled on 2.25%.

- Interestingly (and I don’t think I can take credit for this), Opendoor dropped its lowest 1.5% buyer agent commission ten days after I published about the iBuyer War on Real Estate Commissions.

Some perspective

- Opendoor sold 20,000 houses in 2021. A 0.75% savings in buyer agent commissions is about $53 million annually.

- Compass’s medium term goal of a 2.5% commission split improvement on its 2021 revenues is $160 million annually.

- Zillow wants to generate an additional $250–$300 million from agents per year.

Yes, but: These companies aren’t simply raising prices; they’re offering increased value to agents.

- Opendoor promises partner agents increased deal flow and less time spent on each transaction.

- Compass promises its agents increased deal flow and efficiency from its brand and tech platform.

- Zillow provides agents with exclusive access to pre-qualified buyer leads

The bottom line

Big Tech has big plans to extract hundreds of millions of dollars from real estate agents in the coming years. Amidst a landscape of new models, disruptors, tech innovation and “super apps,” there remains one consistent way to make money in real estate: commissions.

This column does not necessarily reflect the opinion of RealTrends’ editorial department and its owners.

To contact the author of this story:

Mike DelPrete at Mike@mikedp.com

To contact the editor responsible for this story:

Tracey Velt at tvelt@realtrends.com