The pace of change continues to startle, if not amaze me. Just 50-some days ago — when I published this writing — my feeling was that we were in “good times,” and it was appropriate to prepare for change. Admittedly, I did not expect the change to come so fast.

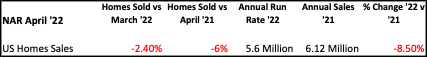

NAR announced April 2022 closings last Thursday. Here are the results:

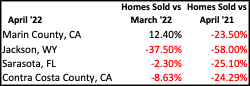

Clearly, these are national headline numbers. We all know real estate is local, if not hyper-local. I checked in with a few of our friends around the country to see how the NAR headlines compare to local realities, and here is what I discovered:

Change in our markets, especially to the downside, will test our value proposition in the industry. Combine a changing market with possible changing regulations, and we need to be sharp in our communication skills with our customers.

Fee transparency

The DOJ investigation and pending litigation about fee transparency and consumer rights is indeed topical in our industry.

I am 100% in favor of fee transparency, and here’s why:

- We have too many part-time real estate professionals in the U.S. The good and great real estate professionals will welcome fee transparency.

- Whether we “divorce” the seller and buyer fees and have each party pay them directly, provide complete transparency in the early agency disclosure statements, and/or provide the transparency via the settlement/closing statement, our clients should 100% know who is paying whom.

- This, by the way, includes referral fees paid to portals, lenders, relocation companies, lead generation companies, and “the friend of a friend.”

Our customers seek and value advice in many aspects of their lives. When seeking medical, legal, financial, architectural, or landscaping services, for example, customers are accustomed to reviewing and negotiating fees.

Customers select the professional they trust and appreciate the scope of services and the related fee schedule.

Why should residential real estate be any different?

The pressure this will put on our industry, and each professional, is how to articulate our value in a manner that supports our proposed fees. The return on investment (ROI) to the client, for lack of a better description. Customers have always had the right to negotiate!

My premise has always been to shine a light for our customers on the market’s performance and our real estate professional’s performance. Use market facts, statistics, specific numbers, and variance percentages to articulate your value proposition. This will put sunshine on your performance and cause your competitors to surface facts to support their own performance.

For instance:

- A brokerage client of mine delivered average days on market (DOM) in 2021 at 11.8 days. This was 50% better than the market average of 17 DOM.

- Their average closing price was 12% higher than the market average. These are remarkable results that justify the fees earned.

- They also negotiate a 6% commission.

They articulate their value proposition as follows:

| Market Average | Specific Client | |||

| Average Sales Price | $1,030,000 | $1,153,600 | 112% | |

| Square Feet | 1,500 | 1,500 | ||

| Price per Square Foot | $687 | $769 | 112% | |

| Market Commission | 5% | $51,500 | $69,216 | 6% |

| Commission Premium | $17,716 | |||

| Seller Additional Proceeds | $105,884 |

Our customers want transparency. They want performance, and they have voted with their checkbooks for years that they value advice over a discount.

Bring on transparency in a changing market! Just be ready to articulate your personal value proposition clearly and quantitatively.

Mark McLaughlin was previously chief real estate strategist for Compass and is founder of McLaughlin Ventures, a real estate consulting company.

This column does not necessarily reflect the opinion of RealTrends’ editorial department and its owners.

To contact the author of this story:

Mark McLaughlin at mark@mclaughlin-ventures.com

To contact the editor responsible for this story:

Tracey Velt at tracey@hwmedia.com