A Double Whammy: Pending Home Sales and Median Home Values Fell in April

Someone once wrote “April is the cruelest month,” which could be applied to home sales this year. According to the National Association of Realtors, pending home sales declined in April, a modest change from the growth seen a month before.

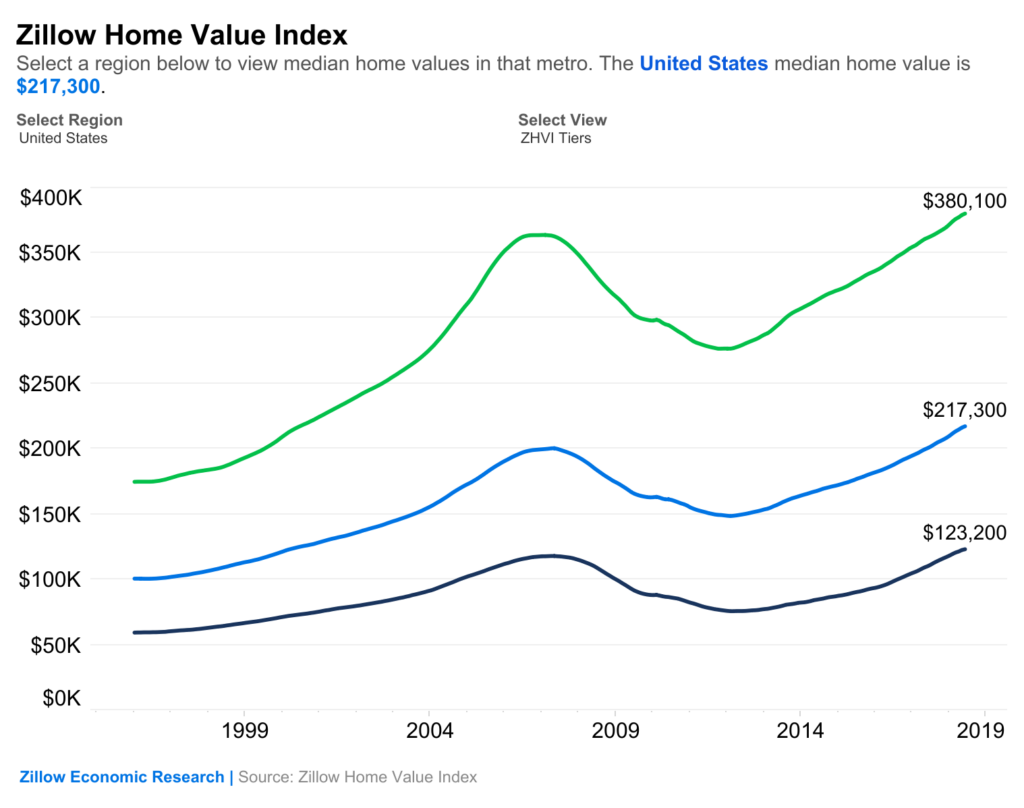

And according to Zillow, the median U.S. home value fell 0.1% in April from March, the first monthly decline in seven years and another signal that the housing market continues to cool. Sixteen of the largest 50 metros posted home value declines in April and have had flat or falling home values since January, raising analysts’ confidence that local home values there may have reached a peak, said Zillow.

And according to Zillow, the median U.S. home value fell 0.1% in April from March, the first monthly decline in seven years and another signal that the housing market continues to cool. Sixteen of the largest 50 metros posted home value declines in April and have had flat or falling home values since January, raising analysts’ confidence that local home values there may have reached a peak, said Zillow.

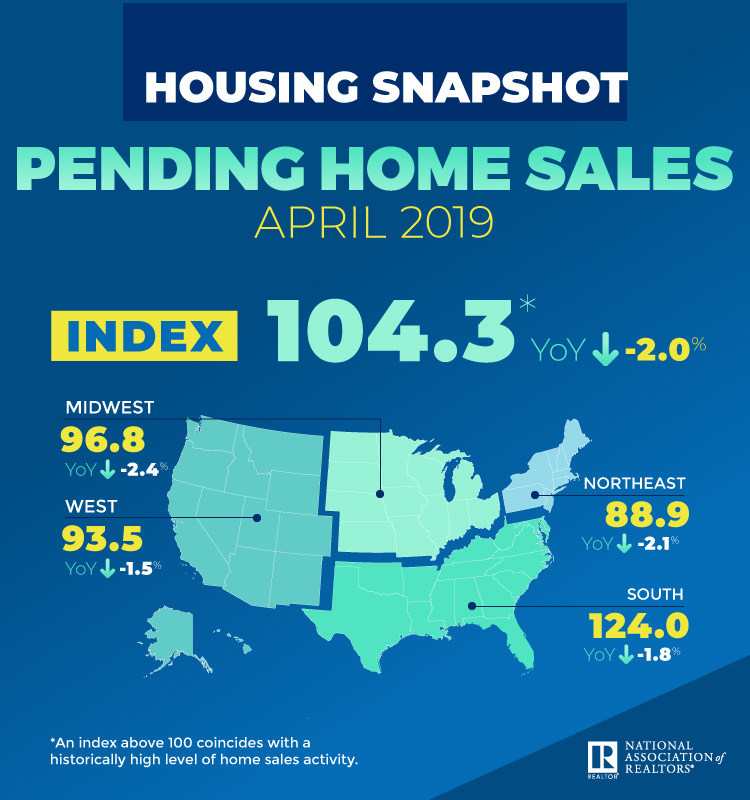

NAR’s Pending Home Sales Index, a forward-looking indicator based on contract signings, fell 1.5% to 104.3 in April, down from 105.9 in March. Year-over-year contract signings declined 2.0%, making this the 16th straight month of annual decreases.

Pending Home Sales April 2019

Pending Home Sales April 2019

Lawrence Yun, NAR chief economist, said the sales dip has yet to account for some of the more favorable trends toward homeownership, such as lower mortgage rates. “Though the latest monthly figure shows a mild decline in contract signings, mortgage applications and consumer confidence have been steadily rising,” he said. “It’s inevitable for sales to turn higher in a few months.”

“Home price appreciation has been the strongest on the lower-end as inventory conditions have been consistently tight on homes priced under $250,000. Price conditions are soft on the upper-end, especially in high tax states like Connecticut, New York and Illinois.” The supply of inventory for homes priced under $250,000 stood at 3.3 months in April, and homes priced $1 million and above recorded an inventory of 8.9 months in April.

Citing active listings from data at realtor.com®, Yun says the year-over-year increases could be a sign of a rise in inventory. San Jose-Sunnyvale-Santa Clara, Calif., Seattle-Tacoma-Bellevue, Wash., San Francisco-Oakland-Hayward, Calif., Portland-Vancouver-Hillsboro, Ore.-Wash., and Nashville-Davidson-Murfreesboro-Franklin, Tenn., saw the largest increase in active listings in April compared to a year ago.

“We are seeing migration to more affordable regions, particularly in the South, where there has been recent job growth and homes are more affordable,” Yun said.

April Pending Home Sales Regional Breakdown

Only one of the four major regions – the Midwest – experienced growth, while the remaining three regions reported a drop in their respective contract activity. The PHSI in the Northeast declined 1.8% to 88.9 in April and is now 2.1% below a year ago. In the Midwest, the index grew 1.3% to 96.8 in April, 2.4% lower than April 2018.

Pending home sales in the South fell 2.5% to an index of 124.0 in April, which is 1.8% lower than last April. The index in the West dropped 1.8% in April to 93.5 and fell only 1.5% below a year ago.